Table of Contents

Executive Summary

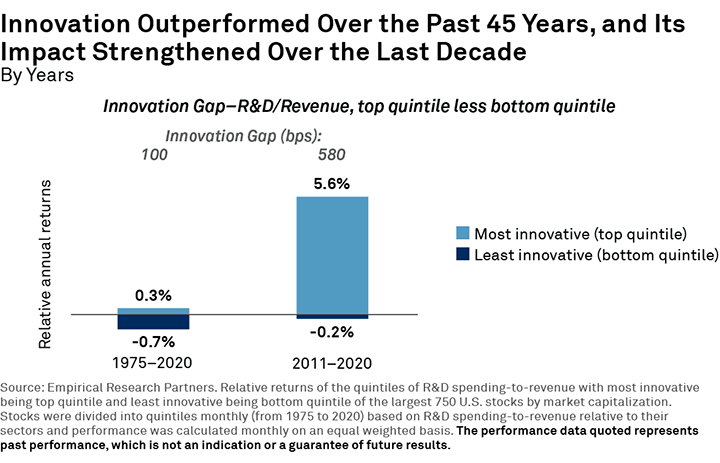

Investors have clear priorities for active equity portfolios: produce alpha and long-term appreciation. Historical data shows that innovative companies, which may be defined as those companies with a high ratio of annual research and development (R&D) investment to revenue, can help investors achieve both of those goals. The most innovative firms have outpaced the market in terms of revenue, profits and share price appreciation over the past 45 years.

Despite this proven relationship, few equity investors allocate directly to innovation. In fact, many investors who participated in a recent Greenwich Associates study lack any dedicated framework for measuring innovation in their investment processes. In this report, we address why many investors fail to take advantage of the performance associated with innovation, and we suggest how to target and take on exposure to innovation in portfolios.

We start by assessing historical performance to demonstrate that: 1) The most innovative companies have outperformed competitors; 2) Adding exposure to innovation can provide diversification benefits and enhance long-term, risk-adjusted returns; and 3) Innovation’s impact on corporate and investment performance is strengthening.

Next, we introduce “Innovation Intensity,” a concept used by Alger to measure and benchmark a portfolio’s exposure to innovation. Building on that concept, we provide a framework for capturing the benefits of innovation in institutions’ investment processes and portfolios.

Introduction: Understanding Innovation and Its Importance

Most investors understand and accept the intuitive relationship of innovation and outperformance. Our study found that 95% of study participants believe that innovative companies will outperform. Additionally, more than three-quarters of respondents believe that innovation is important in portfolio construction, and the majority of those investors state that it has grown in importance over the past two years.

Given this understanding, one would expect investors to incorporate innovation as a factor in their equity portfolios—especially in light of their focus on delivering high absolute returns and alpha. More than half of study participants (54%) see active equity strategies primarily as a tool for alpha generation, about double the share who see either diversification or risk mitigation as the primary role of their active equity managers. Indeed, nearly half of the study participants (46%) have equity portfolios that tilt toward growth, which may suggest that innovation is important and more likely to be found in growth equities than value equities.

Despite this orientation to growth and alpha, most study participants have no discrete allocations to innovation. In fact, most investors in the study are not employing innovation as a factor in their investment structure in any deliberate manner.

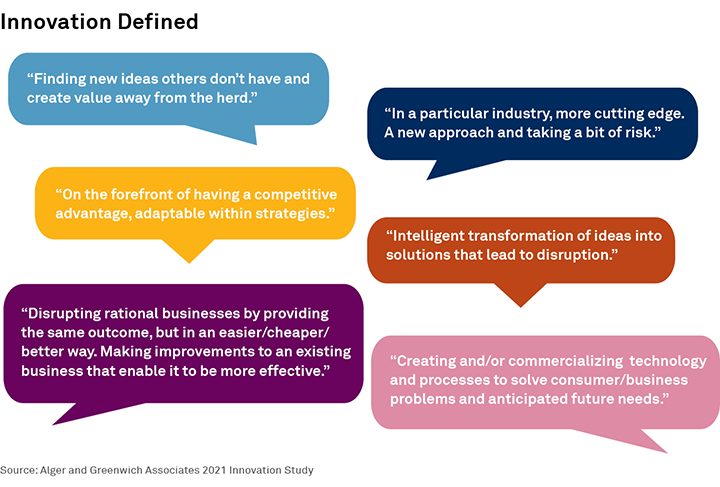

One challenge likely impacting the broader incorporation of innovation is the lack of consistency with regard to definition and measurement, exemplified by the wide-ranging descriptions of innovation provided by the study’s respondents.

Innovation Accelerating

Investors’ sense that innovation is becoming more important to portfolio construction is supported by the accelerating pace of change across society. Today, new products and technologies emerge and permeate markets, our daily lives and the broader economy at an astounding rate, which is creating unprecedented opportunities for companies capable of innovation.

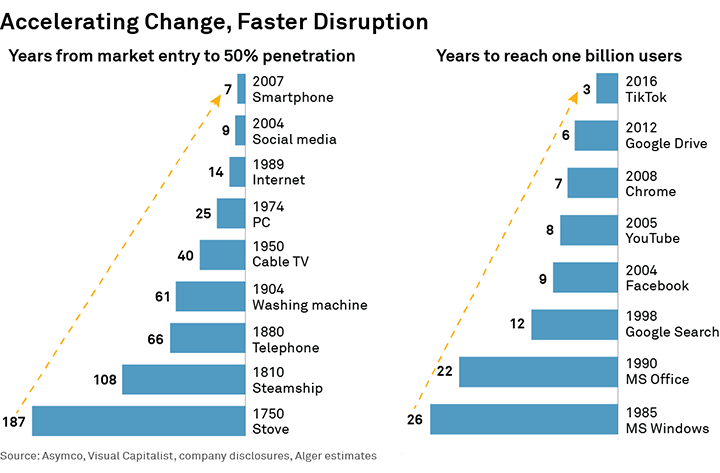

The following graphic illustrates the power of accelerating innovation. As shown in the chart on the left, the telephone took 66 years to hit 50% market penetration. Smartphones crossed the threshold in seven years. Using a more contemporary example, it took Google a dozen years to reach a billion users. TikTok did it in three years.

As new products and services diffuse through society faster and disrupt businesses at a greater rate, we believe innovators may have the ability to enjoy an ever-growing competitive advantage over slower moving rivals. As discussed in the next section, this advantage potentially could lead to stronger growth of sales, earnings and share price.

Innovation’s Historical Outperformance

In a world starved for alpha, one driver of outperformance jumps out: innovation. There are a number of ways to measure innovation. One of the most common is the ratio of annual R&D investment to revenue. Over the past 45 years, companies in the top quintile in R&D/revenue outperformed bottom quintile companies by 100 basis points (bps) per annum. In more recent years, the impact of innovation on performance has been much greater, as companies have dramatically increased their investments in intangible assets such as patents, training, copyrights, branding, and other intellectual capital. Over the past decade, companies in the top quintile in R&D/revenue outperformed the market by 560 bps in annual returns as compared to bottom quintile companies, which have underperformed the market over the same time period.

Consider the more dramatic impact of innovation when looked at through a sector lens. Intuitively, the innovation gap in the information technology sector between the most innovative and least innovative companies is a significant 770 bps. Surprisingly, the consumer cyclicals sector has a larger magnitude of innovation outperformance (1,730 bps), proving that innovation isn’t just related to technology; rather, it is a powerful mindset impacting all areas of the economy and stock market.

Understanding Risk and Return

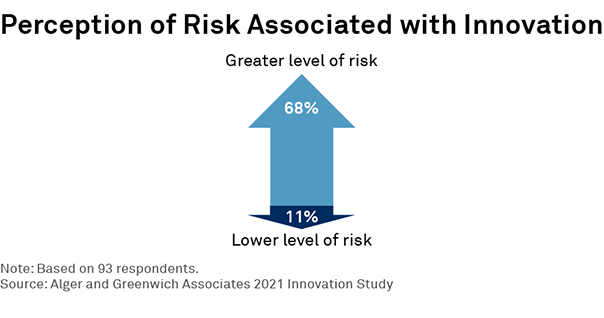

Given innovation’s outperformance, it may be logical to conclude that stocks of innovative companies are inherently riskier. Indeed, two-thirds of study participants believe innovative companies are riskier than the broad equity market.

However, historical data contradicts this belief, with innovative companies having produced this superior performance with the same level of risk as the broader market. Not only is it wrong to assume that innovative companies are riskier than average, innovative companies actually demonstrate significantly lower levels of downside capture than the broader category of growth stocks. In fact, less innovative companies are at risk of losing market share, experiencing business decline and potentially going bankrupt.

Investing in innovation is not without risk and there is no guarantee that investments in R&D will result in a company gaining market share or achieving enhanced revenue. Companies exploring new technologies may face regulatory, political or legal challenges that may adversely impact their competitive positioning and financial prospects. Also, developing technologies to displace older technologies or create new markets may not, in fact, do so, and there may be sector-specific risks as well. As is the case with any industry, there will be winners and losers that emerge, and investors, therefore, need to conduct a significant amount of due diligence on individual companies to assess these risks and opportunities.

As shown in the graphic below, over the past decade, stocks of companies in the top quintile of R&D/revenue have outperformed the market, with downside capture essentially on par with that of the market average.

Adding innovative companies to an investment portfolio can deliver another critical benefit: diversification. Most equity portfolios have significant exposure to growth as either a category or a style factor. As shown in the following graphic, innovative stocks display relatively low correlation to growth stocks, regardless of the proxy used to measure innovation. Adding exposure to innovation can, therefore, increase portfolio diversification.

The Innovation Quandary

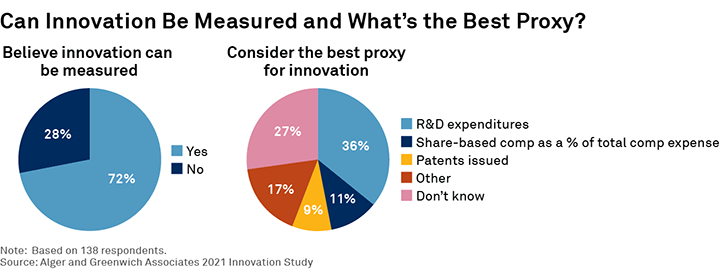

Although a large majority of study participants believe that innovation can be measured, there is no consensus on how to do so. As shown in the following graphic, more than a quarter of study participants can’t name an optimal proxy for innovation and the remainder are divided on which metric to use.

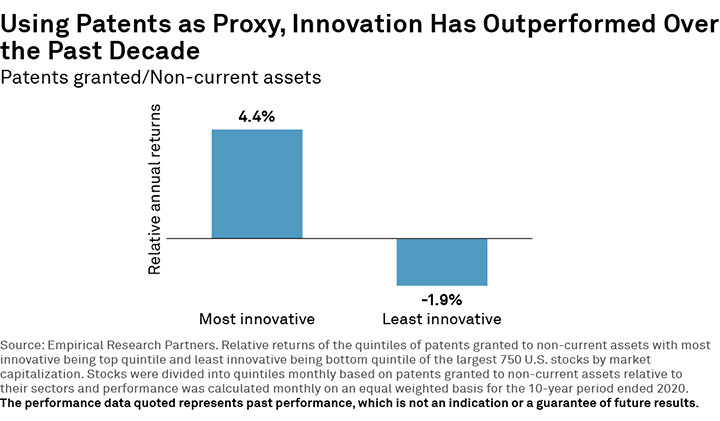

The good news for investors is that there’s no need to be stymied by confusion about which proxy to use. In fact, relying on a single proxy may be a mistake. Research demonstrates that the relationship between innovation and outperformance persists using a variety of proxies. For example, the next graphic shows the impact of innovation as measured by the ratio of patents granted to non-current assets, which includes investments, property, equipment, intangible assets and other assets that are capitalized rather than expensed on a company’s balance sheet.

Much more important than the selection of a proxy is the creation of a process that captures the performance, risk management and diversification benefits of innovation. In the final section of this report, we outline a framework for identifying, measuring and building a portfolio allocation to innovation.

Investing in Innovation

For an equity investor, we believe the best way to think about innovation is as a factor, similar to growth, value or size. Academic research demonstrates the existence of a return premium that can be harvested by investors for each of these commonly used factors. We believe a similar premium exists for innovation, and that investors can capture that premium by introducing into their investment processes metrics that measure and rank companies in terms of innovation.

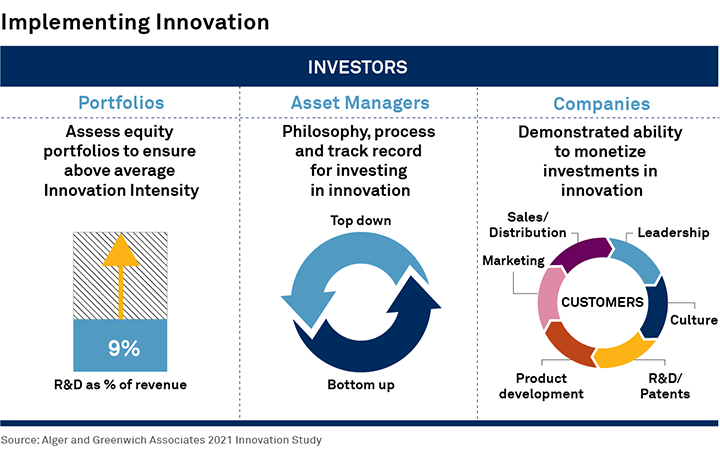

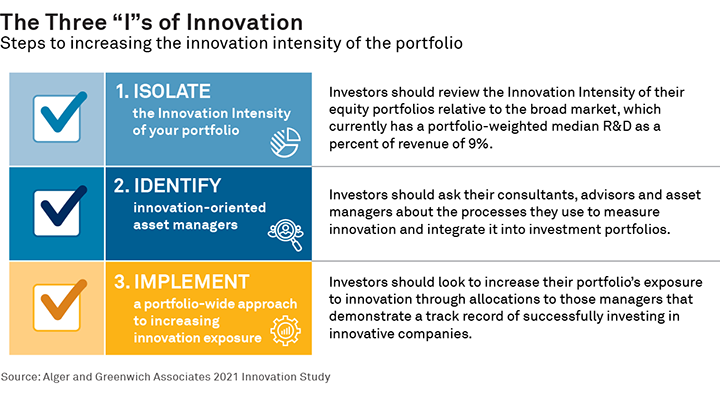

To measure the level of innovation on investment portfolios, Alger utilizes the concept of “Innovation Intensity.” One of the more accessible measures of Innovation Intensity may be R&D as a percentage of revenue. Investors should aim for an Innovation Intensity greater than the broad market, currently implying a portfolio-weighted median R&D as a percent of revenue over 9% (as of 6/30/2021).

However, to maximize innovation’s alpha and diversification potential, investors should look beyond individual proxies like R&D spending. Capturing the full return premium associated with innovation requires a more comprehensive investment framework that identifies companies with proven, repeatable processes for cultivating and monetizing innovation. This framework includes bottom-up fundamental analysis that evaluates an individual company’s capabilities in product development, marketing and distribution, which comprise the pathway from investment to commercialized innovation.

Conclusion

Despite the widespread belief that innovative companies outperform, few equity investors allocate directly to innovation. Based on this analysis, Greenwich Associates believes investors may be well served by taking specific action utilizing the following framework.

Investors should ask their consultants, advisors and asset managers about the processes they use to measure innovation and integrate it into investment portfolios. Asset owners should adopt questions about philosophy and process for investing in innovation into their manager review process. Additionally, investors should carefully assess a manager’s track record of implementing an innovation framework and its impact on a strategy’s performance.

By following these simple steps, investors can potentially harness the power of innovation as a driver of investment returns—a factor that we believe will only expand in impact as the pace of innovation continues to accelerate across companies, markets and our lives.

Davis Walmsley, Greenwich Associates Head of Client Relationships, Investment Management, advises on the asset management market in North America.

MethodologyA 2021 Greenwich Associates study of institutional investors, financial advisors, intermediaries, and consultants evaluated perceptions of innovation and the role that innovation plays in portfolios. Greenwich Associates interviewed 138 key decision-makers in the United States at over 100 financial institutions overseeing assets in excess of $18 trillion.