The results of the Greenwich Associates 2015 Canadian Exchange-Traded Funds Study show that Canadian institutions rank as some of the most active and sophisticated ETF investors in the institutional marketplace. Among the trends placing Canadian institutions at the head of the global pack:

- In addition to using ETFs for tactical portfolio functions, Canadian institutions are employing the funds to obtain long-term exposures central to their investment strategies. Sixty-three percent of Canadian institutional ETF assets today are categorized as strategic, with portfolio diversification and obtaining core investment exposures cited as the top two reasons for ETF use.

- Canadian institutions are moving faster than their counterparts in other markets to adopt ETFs in fixed income and other asset classes beyond equities. Sixty-eight percent of Canadian institutional ETF users employ the funds in fixed income. That share is expected to increase as investors respond to the shifting interest-rate environment and move to address liquidity concerns.

- Canadian institutions are early adopters of new ETF products. Forty-four percent of Canadian institutional ETF users employ non-market-cap weighted/smart-beta ETFs, with a sizable share of institutions using these innovative products in fixed income. Thirty-one percent of Canadian institutional ETF users invest in currency-hedged ETFs.

- Canadian institutions have recognized ETFs’ ability to deliver cost-effective beta and are actively replacing derivatives positions in their portfolios with ETFs. Eighty percent of the institutional ETF users in the study expect to replace an existing equity futures position with ETFs in the next year.

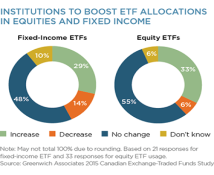

Based on these and other trends, nearly one-third of institutional ETF users in Canada plan to increase ETF allocations in the coming year. As they source new ETF investments, institutions are looking closely at ETF expense ratios and the alignment of individual funds with their own exposure needs.

MethodologyGreenwich Associates interviewed 50 Canada-based institutional investors, 37 of which are exchanged-traded fund users and 13 are non-users, in an effort to track and uncover usage trends. Respondents included 33 asset managers that actively manage money for institutional funds, 12 institutional funds, including corporate pensions, public pensions, foundations, and endowments, and five insurance companies.