Market structure principles, not prescriptions, are needed for the U.S. Treasury market The U.S. Treasury market needs more oversight. Our research and my personal observations over the past several years have made that clear. Oversight,...

From a fund type perspective, it should come as no surprise that hedge funds - nearly 90% of those in our study - use derivatives, above the roughly 60% of asset managers that do the same. Their leveraged approach to investing coupled with...

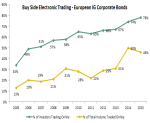

Interviews earlier this year with nearly 60 global bond investors found that more than expected - 29% - either currently make prices in the corporate bond market or plan ton do so in the next 12 months. In and of itself this finding...

In my first blog post on the evolving blockchain technology landscape I wrote about how, following the hype of 2015, this year would see technology companies and financial services firms explore different ways to use the blockchain technology in...

Only a small few markets have been able to migrate more than half of trading volume to the screen. FX trades roughly three-quarters of its volume electronically for instance. Index CDS in the US trades over 90% of its volume...

This was my first time chatting with Betty Liu at Bloomberg TV, which I really enjoyed. We discussed why the Fed shouldn't hyper focus on short term market volatility, how bond market liquidity has changed but a crisis isn't likely, and last but not...

The biggest FinTech story of last week was the announcement that not only had Digital Asset Holdings (DAH) raised $52mm in funding, but had also secured a strategic contract to develop distributed ledger (blockchain) settlement solutions for...

The anniversary of the Treasury "flash crash" and next week's market structure meeting at the NY Fed has brought with it a renewed focus on the functioning of the US Treasury trading. In an effort to provider further clarity into how this...

We recently published research examining how the market for trading US Treasuries has changed and is likely to change in the coming years (U.S. Treasury Trading: The Intersection of Liquidity Makers and Takers). But while market participants...

US equity markets are always touted as the poster child for electronic trading, but our most recent electronic trading study results (see chart below) prove that view is somewhat misguided. Driven primarily by new rules requiring index CDS...

Pages

Need to Contact Us ?

We are always here to help you