Some quick thoughts on market structure as we head into today's sell off: 1) Volumes sure to be 12-15 billion if not higher. Can our venues truly handle this volatility/flow? 2) For years, we have been told about venue stress testing. Let's...

Some quick thoughts on market structure as we head into today's sell off: 1) Volumes sure to be 12-15 billion if not higher. Can our venues truly handle this volatility/flow? 2) For years, we have been told about venue stress testing. Let's...

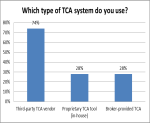

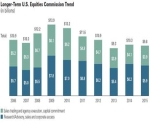

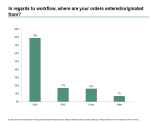

As MiFID II turns up the pressure on the delineation of payment for research versus execution, institutional investors may soon increase their attention on brokerage services that materially enhance multiple aspect of their execution process....

No new swaps have been mandated to trade on SEFs since the original determinations were made two years ago. The CFTC recently called a panel to understand why and what they should do to change the logjam we are in the middle of now. We were pleased...

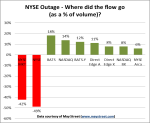

The extended discussion surrounding the NYSE outage from last Wednesday seems your typical case of rubbernecking. Maybe it's wishful thinking that this event will fit neatly with the Flash Boys script, painting the US equity markets in...

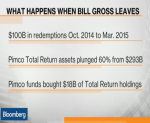

When Bill Gross left PIMCO many in the market were concerned that the expected outflows would crush bond prices as they were forced to sell. This turned out to not be the case, and we shouldn’t really be surprised. Major market participants like...

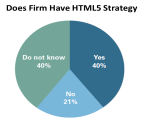

Growing uncertainty about the future of operating systems and devices used by financial services firms is forcing technologists to consider technology-agnostic application development. Our latest research suggests that companies developing...

A move by the European regulators to “unbundle” payments for research from commissions paid on equity trades will have potentially significant and negative consequences for both the buy side and sell side. The European Commission is preparing...

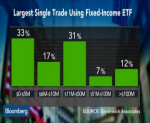

We recently published new research examining the use of Fixed Income ETFs by institutional investors. Our analysis found that the increasing acceptance of ETFs as an institutional (rather than retail) investment tool coupled with challenged...

Excel is the biggest killer app of all time. Yeah, web browsers are pretty useful and Instagram was sold for $1 billion, but when it comes to managing numbers nothing can touch Excel. This is why global financial markets continue to...

A crisis is a crisis because most people didn't see it coming. Unexpected events freaks people out causing a bad chain of events - a crisis. So despite evidence that a liquidity crisis is on the horizon in the bond market, wide spread recognition...

We are always here to help you