With the recent market volatility and uncertainty, managers and consultants have been recommending that investors stay the course. Most investors are taking that advice and not making snap decisions. However, investors in many markets are concerned and are closely monitoring the situation, with important implications for asset managers related to service. Here we look back at the pandemic to consider some of the key lessons learned during another period of significant volatility.

Five years ago, the pandemic hit with full force. In addition to adjusting to working from home, managers had to manage and maintain a very high level of client contact. During that time, some managers excelled while others did not. Our 2020 research revealed notable shifts in the perceptions of asset managers’ relationship management and service capabilities, in large part due to their ability to effectively engage clients during a time of uncertainty and volatility.

In the first weeks of the pandemic in 2020, we observed that:

- Some managers “actively stepped forward.” Other managers either did not sufficiently grasp the situation, froze or did not have the capability to respond in the moment.

- The range of perceptions of managers’ service quality expanded, with some managers reaching new heights and others reaching new lows.

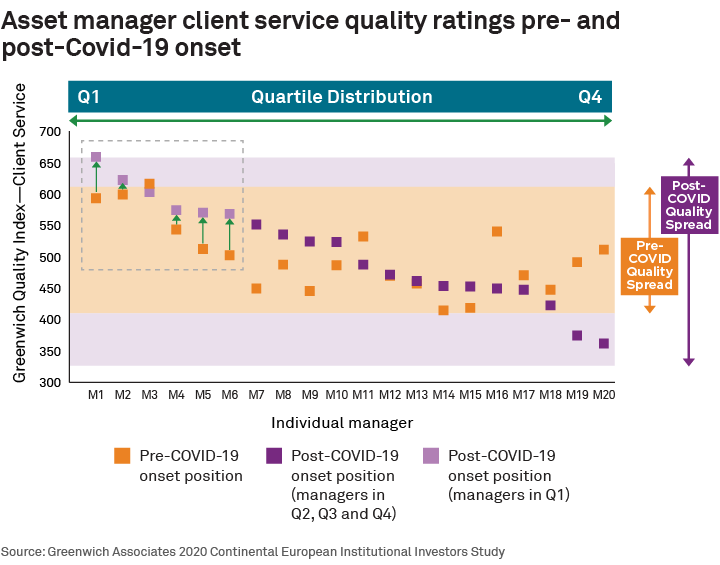

- Managers with strong existing service quality propositions pre-pandemic (e.g., receiving first quartile client feedback scores) were in many cases able to up their game and obtain even better relative feedback post-COVID-19 onset. Their focus and investment in service paid significant dividends.

- Most managers in lower quartiles pre-pandemic were unable to differentiate themselves through their service proposition and, in many cases, slipped back competitively.

The chart below shows an example of institutional investor feedback related to top European asset managers as of mid-April 2020.

In the spring of 2020, we conducted a series of flash studies called Pandemic Perspectives to gauge investors’ attitudes and expectations. Looking back, what can we learn from that experience? The key findings include:

- Service matters.

- The relative importance of service is heightened during periods of volatility and uncertainty.

- Clients’ needs increase, and they expect managers to respond.

- Managers need to step forward proactively; silence is not an option.

- Client engagement must be conducted in a manner that is balanced and mindful of investors’ needs and their time.

- Investors pay attention to the differences in service levels provided by their managers during these periods.

- Trust is built over time but can be lost quickly.

- Perceptions of managers change more dramatically during times of stress, or “moments of truth.”

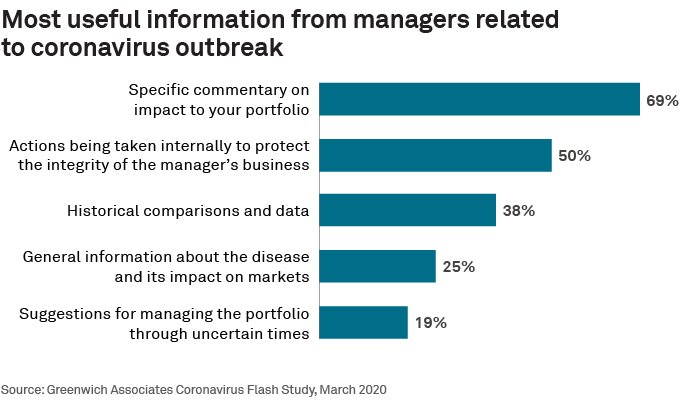

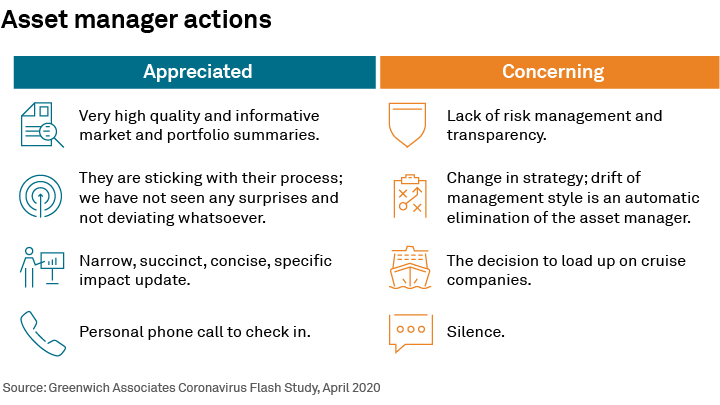

When these moments of truth arise, investors expect a higher level of responsiveness, regular updates and check-ins, no surprises from managers, empathy, and solutions. At the same time, managers need to find a balance and not bombard clients with lower value information and insights. During the pandemic, the most important information that managers provided was specific commentary on the impact to clients’ portfolios. Historical comparisons and data, and suggestions for managing the portfolio through uncertain times were also valued.

High-quality and insightful portfolio and market summaries, risk management and transparency provided to clients succinctly was most appreciated, as was personal outreach. From an investment perspective, sticking with the investment strategy and not drifting during the period of uncertainty was critical.

As with investment strategy and decision-making, a period of uncertainty and volatility provides managers with an environment to clearly demonstrate their service capabilities. Managers who are prepared and step up and deliver can strengthen client relationships, build trust and gain competitive advantage. On the flip side, there is downside risk for managers who have not invested in service, are unprepared and don’t deliver during these periods. Clearly understanding clients’ service expectations, how service practices are perceived relative to competitors and acting on those insights will be critical in the coming months.