Corporate treasurers need new resources and budget authority to keep pace with growing responsibilities and increased technology needs.

Most corporate treasury departments do not have an independent technology budget. Instead, treasurers and their staff usually rely on centralized IT budgets, submitting their requests to be integrated into organization-wide development and investment plans.

In the past, this situation, while not ideal, was at least workable. Upgrades and maintenance to treasury platforms running core functions like cash and liquidity management were fairly regular and predictable. Today, however, treasury departments and corporate treasurers are being asked to do much more. As detailed in our last blog post, Introducing Treasury 2.0, the role of the treasury is evolving and expanding.

Corporate treasurers are being asked to take on more strategic roles, including business planning and risk management. As part of that shift, they are becoming an increasingly valuable resource to CFOs, other C-suite officers and business leaders. All of these executives are relying on the data and analytics of the treasury department to inform decision-making.

Corporate treasurers are also under pressure to increase efficiency and productivity within their own departments. Two-thirds of the corporate treasurers participating in a recent Coalition Greenwich study cite operational efficiency as an increased area of focus for themselves and their departments. Part of that pressure is coming from the overall push across the corporate world to digitize, become more efficient and lower costs.

However, the new focus on efficiency is also partially a result of treasurers’ new responsibilities. With more than half of treasurers reporting increased demand from senior management for their expertise, treasury professionals across the board need to find ways to free up time by making day-to-day operations more efficient.

Wanted: Budget Autonomy

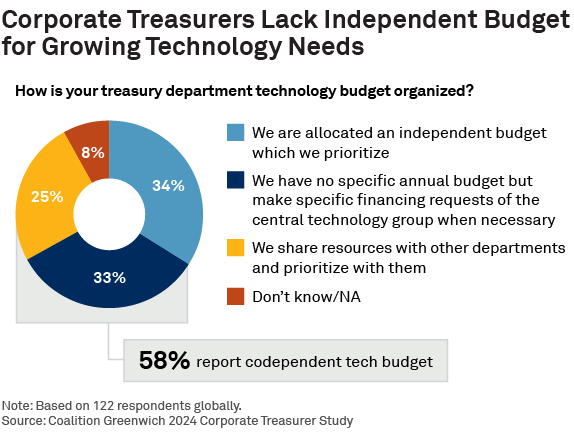

Only about a third of corporate treasurers say they have an independent technology budget they can use to drive those efficiency enhancements. Nearly 60% say they share resources and priorities with other departments through a centralized budget or have no specific annual budget at all, rather submitting specific financing requests to the central IT group when needed.

This budgeting process is making it difficult for corporate treasurers to meet their departments’ fast-changing needs. More than half of treasurers in the study say business transformation projects are an increasing area of focus for them, and almost 50% cite system integration as a growing responsibility. Treasurers are also spending more time thinking about how to improve platform connectivity between their departments and the rest of the company and enhance data quality.

Tackling technology initiatives of that level of complexity and importance is challenging in the best of times—never mind when leaders don’t have control over their own budgets. Ad hoc budgeting processes often lead to underfunding and leave treasury departments chronically lacking the ability to project, plan and adjust strategically.

Creative Ways to Access Technology Resources

As companies lean more heavily on corporate treasury for strategic planning, risk management and other essential tasks, they should assign treasury departments with independent technology budgets. Budget autonomy will not only allow corporate treasurers to implement efficiency enhancements but also give them more freedom to upgrade data and analytic platforms, and integrate artificial intelligence applications and predictive analytics that are transforming business.

In the meantime, we have one suggestion for corporate treasurers looking to acquire the technology they need to keep pace with their expanding list of responsibilities: Look to your banks for off-budget technology resources.

Although many treasury departments don’t have autonomous technology budgets, they do have full control over their acquisition of banking services. In cash/treasury management and other functions, banks are increasingly bundling technology offerings with their execution services. Corporate treasurers and staff should be holding continuous conversations with banks to understand exactly what technology solutions are available.

It’s not only pure technology—banks also provide data feeds, analytics and in some cases, temporary staffing to help with implementation. This fits well with the treasurer’s understanding that one should not only think about having a better machine, but also about the quality of data one puts into that machine and its connectivity with other systems used at the corporation.

Because many of these capabilities and resources can be billed as bank services as opposed to technology, treasury departments can fund them independently through the banking budget instead of the technology budget.

Sometimes you need to get creative to get the resources you need to succeed.

Toby Miarka and Matthew Noujaim are the authors of this publication.