As costs related to compliance rise and budgets compress across the financial services industry, technology end users are demanding more use cases for applications. In the case of digital communications, end users have traditionally sent communications data into archiving systems and left it there untouched.

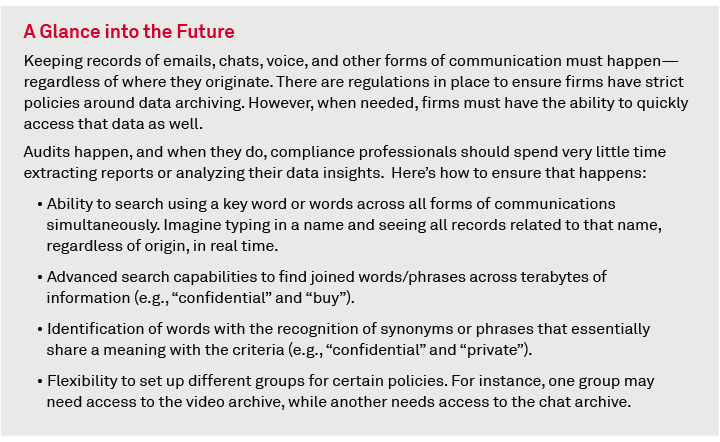

However, as regulatory requirements tighten for banks and other firms, and regulators are cracking down with massive recordkeeping fines, archiving solutions need to do more than just “set it and forget it.”

What’s Missing?

The use of digital communications archiving solutions is nothing new. Financial services firms have always needed to retain data to remain compliant. However, this need has grown substantially in recent years, as regulated users began working remotely in 2020 and continue to work on a hybrid schedule today.

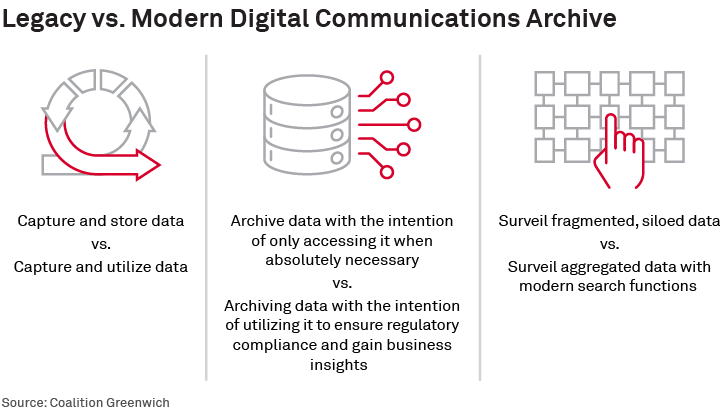

Providers of data archiving solutions have long focused on retention. Years ago, this was the right approach, as institutions just needed to hold on to information for a certain number of years. However, today’s compliance standards require firms to also be able to pull insights from this data to understand more about employee behavior, conduct risks and so on. Firms that implement data archiving solutions that can extract insights from stored data have a competitive advantage over firms with legacy systems.

Today’s technology should satisfy as many compliance gaps as possible. For instance, financial services firms with regulated users should be able to safely store and access a variety of enterprise data, including electronic communications, voice, video, chat, and more. As legacy technology was not designed to store data coming from multiple communication sources, the information in these systems tends to be siloed, fragmented and difficult to access.

Cost efficiency—or lack thereof—is another piece of this story. As more communications channels are added, the number of solutions has ticked higher in tandem, increasing costs. Legacy storage architecture drives up expenses due to inefficiency, compared to modern technology like the cloud. Firms have an opportunity to bring all their data together in a cloud storage technology that can lower costs by as much as 20%, resulting in millions of dollars in savings for global banks.

The Future of Archiving

Given the emergence of modern communication channels, firms should look to implement solutions that go beyond simple archiving. Next-generation digital archiving solutions, including cross-industry offerings from Microsoft and financial services-specific solutions such as NICE Actimize's product, should be able to not only securely store communications data in one system, but also surveil that data, providing automated monitoring and seamless data search and extraction—saving time and improving efficiency.

Conclusion

As compliance budgets continue to tighten, industry professionals need to look for ways to streamline processes and optimize resources across technology stacks. To do this, an end-to-end compliance solution is key. Compliance heads should look to a technology vendor that can capture all communications data from every traditional and emerging communication channel, archive that data in one solution, and be able to perform advanced surveillance on that data to spot conduct risks.

Investing in technology that ensures data can be recorded, archived and surveilled in one solution will enable firms to lower costs, streamline processes and avoid regulatory risks.

Audrey Costabile is the author of this publication.