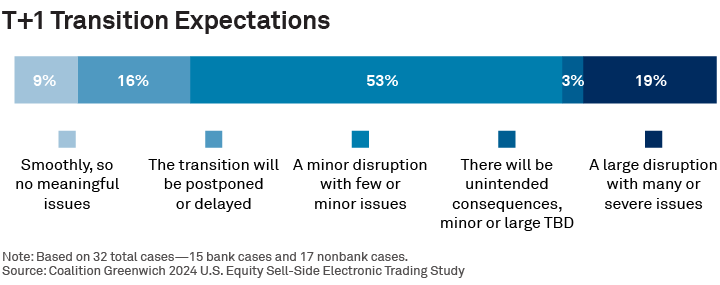

About a fifth of U.S. market-structure-savvy, sell-side electronic equities professionals think the transition to T+1 will come with a large disruption with many or severe issues. Only 9% are optimistic and expect a smooth rollout. This, according to data from our recent study that gathered insights from 32 bank and nonbank broker-dealers.

But perhaps we should take those views with a grain of salt? Over a quarter of respondents at banks expected the transition to be delayed or postponed, with only 6% of nonbank broker-dealers agreeing. Clearly, the majority was right this time.

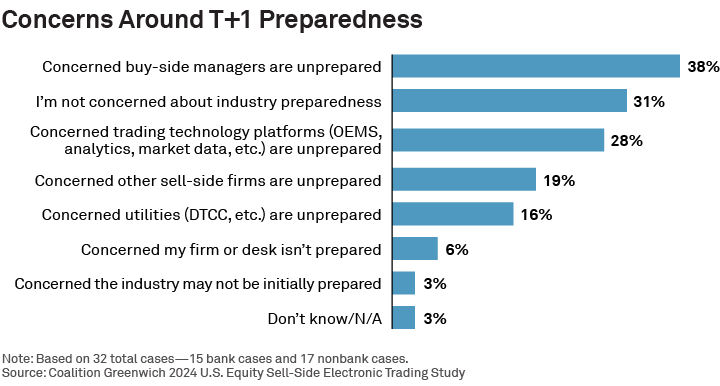

In a shocking twist, while just a few are concerned about their own desk’s preparedness, many more are worried about everyone else:

- A fifth are concerned about other brokers,

- Over a third about the buy side, and

- Over a quarter about trading technology platforms.

In other words, the sell side thinks there will be issues, but it will be someone else’s fault. Hedging is their strong suit, after all.

Jesse Forster is the author of this publication.