One of the more exciting markets in European institutional asset management in recent years is the Nordics. While individual countries in their own rights, as a collective, Denmark, Finland, Iceland, Norway, and Sweden boast a strong asset base and a unique but empirically sound approach to asset allocation. They also feature the world’s largest sovereign wealth fund, the Government Pension Fund of Norway, at over US$1.7 trillion.

Understandably, it’s no surprise that non-Nordic asset managers would be attracted to the growth opportunities of the region. However, for years, we observed that very few foreign managers have been able to build fruitful, durable franchises in the market, so we wanted to explore the reasons why.

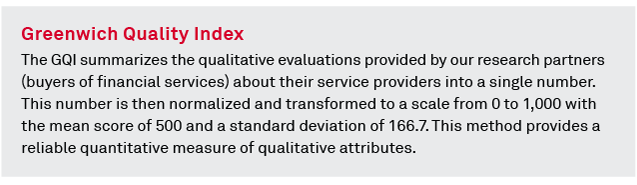

Nordic Managers Outperform in Client Satisfaction

Coalition Greenwich has been conducting research in the European institutional market for 26 years, and our most recent study, in which we executed 67 interviews with Nordic asset owners, concluded at the end of summer. In these interviews, institutional investors provide information on key portfolio metrics and share feedback on the managers with whom they work. This feedback underlies our Greenwich Quality Index (GQI) and serves as the base of our analysis.

First, we identified 25 investment managers (12 Nordic, 13 non-Nordic) for whom we receive consistent, robust, year-on-year feedback as part of our annual interviews with Nordic institutions. We analyzed the deltas between the average client satisfaction scores of Nordic managers and those of non-Nordic peers from investment, service and overall perspectives. What we found was quite remarkable.

As shown above, the Nordic managers showed significantly higher client satisfaction over foreign competitors, particularly with regard to the service elements of the relationship. Further, this trend is only accelerating, as the deltas between the two camps have only increased in recent years.

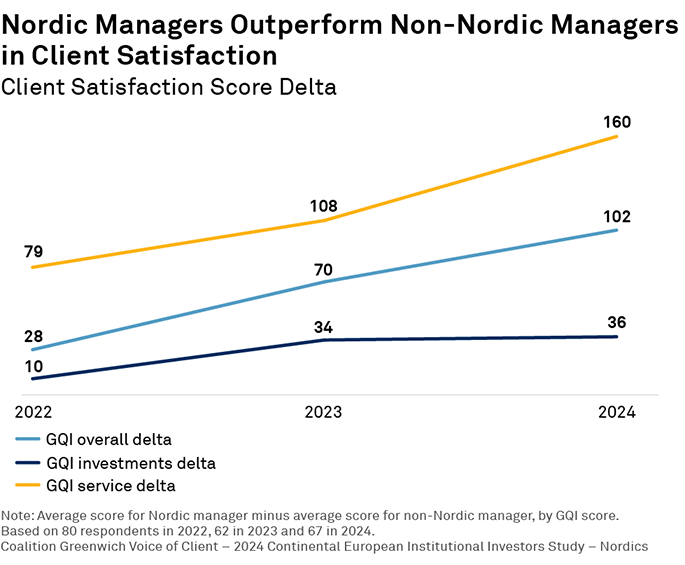

Next, we wanted to dig deeper to understand exactly what Nordic managers are doing to outperform foreign competitors so convincingly. To do this, we conducted a similar analysis looking at the specific service KPIs upon which institutional investors grade their preferred managers.

Again, we found that Nordic managers outperformed non-Nordic competitors across all of the relevant factors that we track. Further, also similar to our overall analysis, the deltas of Nordic over non-Nordic managers are increasing demonstrably year-on-year.

We zoomed in on the three leading areas of Nordic manager differentiation:

- Usefulness of interactions outside of formal reviews

- Capabilities of relationship managers

- Understanding of client goals and objectives

All of these highlight the inevitably human nature of our business. Nordic institutions face uniquely Nordic challenges, and they have a natural tendency of entrusting their investments to partners who fully understand and appreciate the complexity of their fears and ambitions.

How Foreign Managers Can Succeed

So how can foreign managers compete in the Nordics? First, as highlighed in the first graphic, Nordic managers have a relatively small advantage with regard to the investment elements of the overall client-manager relationship. Quite reasonably, Nordic managers may have a more nuanced understanding of Nordic markets or may be better equipped to modify certain strategies for Nordic audiences, but the sheer scale and sophistication of foreign managers have their own advantages, too. On average, Nordic managers cannot compete with the quality of analysis, depth of resources or superiority of computing power provided by global competitors.

Second, Nordic institutions do not seem keen on foreign managers deploying a fly-in-fly-out coverage strategy. They clearly prefer local investment partners with a refined understanding of the market. Foreign managers would do well to hire local, even partner with domestic palyers. Outright acquisition could be another interesting avenue to successful market entry.

Lastly, foreign asset managers still control a considerable share of the Nordic market. Of the 501 client-manager relationships captured in our Nordic reseach, 49% were run by non-Nordic managers. Even in light of the gains Nordic managers have made over the last several years, market share has stayed relatively constant. If foreign managers are able to learn from the successes of their regional peers, they stand a fighting chance of holding, even growing, their share of Nordic institutional assets in the future.

If this topic interests you, please get in touch, as we have a depth of research and analysis available to asset managers operating in the Nordic institutional market.