It’s time to rebrand the corporate treasurer.

Over the past decade, the corporate treasury function has grown beyond its traditional role and evolved into a central platform that delivers essential data and increasingly powerful analytics to every part of the corporation. As these capabilities become more integrated into corporate workflows and planning, companies need to update the image of corporate treasury as a means of attracting the talented, tech-savvy professionals they will need to staff this important function.

Of course, treasurers’ main responsibilities still include traditional functions like liquidity and cash management, internal reporting, and regulatory reporting and compliance. However, the very nature of the position is changing as the analytic capabilities of the treasury department become more important to other parts of the business—including the C-suite.

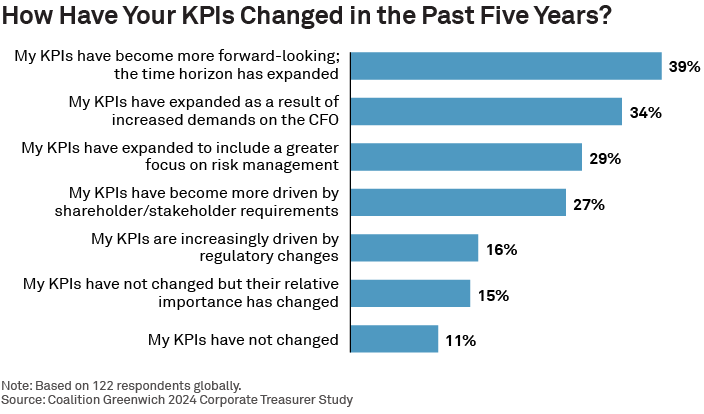

Earlier this year, Coalition Greenwich interviewed more than 120 corporate treasurers from large companies in Europe, North America and Asia. Nine out of 10 of these treasurers say the key performance metrics used by their companies to assess the treasurers’ performance have changed over the past five years. Treasurers’ KPIs have shifted to become less focused on the execution of basic treasury functions and more linked to forward-looking risk management and strategic planning.

Driving this change is a growing reliance—by CFOs, other senior executives and other departments—on the data and analytic power that now rests within corporate treasury. It is increasingly common for corporate treasurers to support the CFO, participate in high-level strategic discussions and play a role in informing and helping to make senior management decisions.

These additional responsibilities are taking up more time for corporate treasurers and their staff. The need to maintain day-to-day operations while also meeting these growing demands is driving an increased need for technology transformation to enhance the efficiency of treasury operations.

Two-thirds of corporate treasurers say improving operational efficiency has become a bigger priority in their jobs. As part of that effort, corporate treasurers are driving initiatives to digitize, automate and optimize treasury functions. (Look out for our next blog where we will look at challenges corporate treasurers face in upgrading technology and offer some recommendations about how treasurers can get the most bang for their buck with technology strategies and budgets.)

Corporate Treasury Transformed

What our research makes clear is that the corporate treasury function is evolving quickly—but external perceptions are not keeping pace. Outside of the department, corporate treasurers and other treasury professionals are often still seen as the people who “keep the books.” In reality, the treasury function is emerging as an analytics center of excellence that operates almost like a central processing unit (CPU) for companies, powering workflows and decision-making across the organization, often enabling key strategic outcomes.

That role will only grow in importance as analytics become more powerful, companies integrate artificial intelligence deeper into their workflows and planning, and CFOs, business unit heads and other decision-makers rely more heavily on data-driven business and financial insights.

We believe it is critical that companies communicate a more realistic picture of the corporate treasurer and treasury function. If treasury is indeed to play a more central role in mission-critical functions like strategic planning and risk management, companies will need to staff the department with talented, tech-savvy professionals.

In today’s tight labor markets, companies are struggling to find, hire and retain qualified candidates in all departments. That challenge becomes even harder if jobs in the treasury function are too often seen as simply keeping the books to support “running the firm,” while in reality, treasury functions are equally instrumental to “changing the firm.”

The truth is, corporate treasurers and other treasury professionals face an expanding range of responsibilities and opportunities in technology transformation, data analytics and strategy. We hope our research helps companies and professional organizations rebrand the role of the corporate treasurer and treasury department to an image that better aligns with the realities of the 21st century treasury function.

Toby Miarka and Matthew Noujaim are the authors of this publication.