As we look back on the past year, it's clear that market structure and technology continue to shape capital markets in every way. Our nearly 80 published reports, blogs and webinars in 2024 examine in detail how those changes are shaping markets and what to expect in the year ahead.

While I focus on equities, below are some charts from other asset classes I found most interesting. Covering topics like trade automation, electronic trading and content consumption, here are my picks for the top other-than-equities charts of 2024.

Automation nation

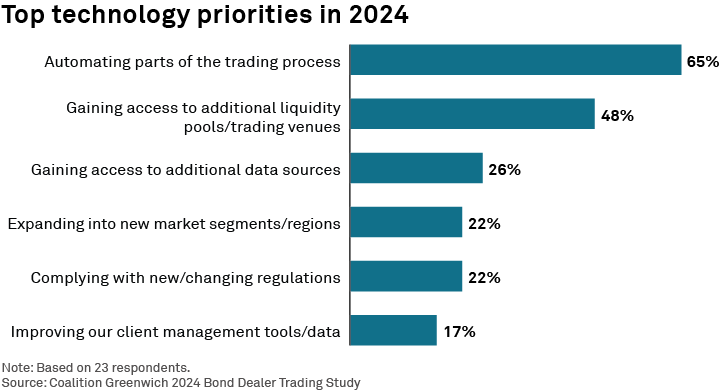

First up is Top technology priorities in 2024 that appeared in Corporate Bond Dealers Focus on Trade Automation last summer.

Equity trading is well down the path of trade automation, but it’s not alone. In fact, almost two-thirds of bond dealers said their top tech priority for 2024 is automating parts of the trading process.

While the largest dealers and newer tech-savvy liquidity providers have made amazing progress in automating their trading in the bond market, smaller firms are fighting to keep up with both market volumes and their competitors.

But not everything can or should be automated. As with their equity peers, human traders come in handy particularly for orders falling outside an auto-quoter’s coverage area, often due to order size or illiquidity (trade difficulty).

Speaking of electronic trading…

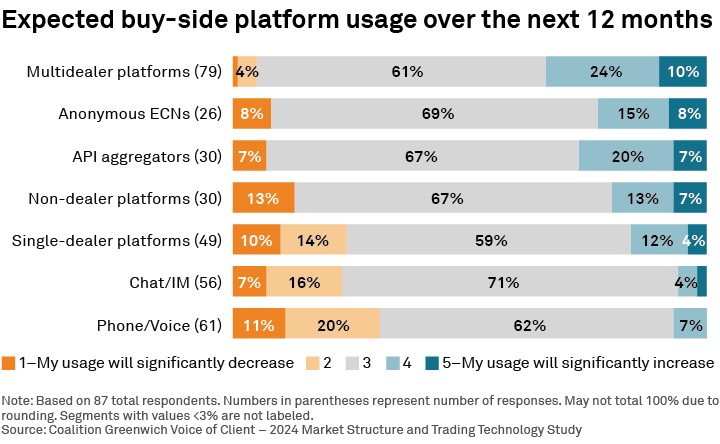

The continued focus on trade automation for convertible bonds and FX has led to more interest in using multidealer platforms (MDPs) to compare prices and execute electronically across multiple dealers. As we noted in Why the Buy Side Chooses their FX Dealers and Trading Venues, a third of buy-side FX traders plan to increase their use of MDPs in the coming year. Meanwhile, they expect a decline in more-manual trading methods like chat and voice.

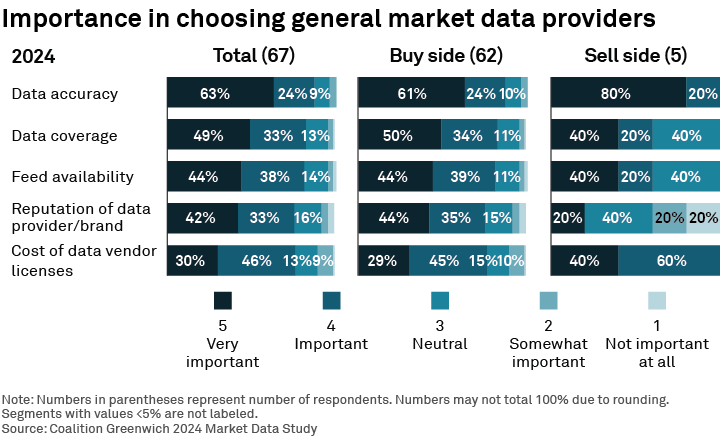

Can’t put a price on quality

When it comes to choosing market data providers, both buy- and sell-side firms prioritize accuracy (quality) over cost, as we noted in Advanced Technology Use Gives Market Data a Boost. As with equities, traders across other asset classes don’t want to be penny-wise but pound-foolish. They’re willing or even eager to pay for high quality products and services.

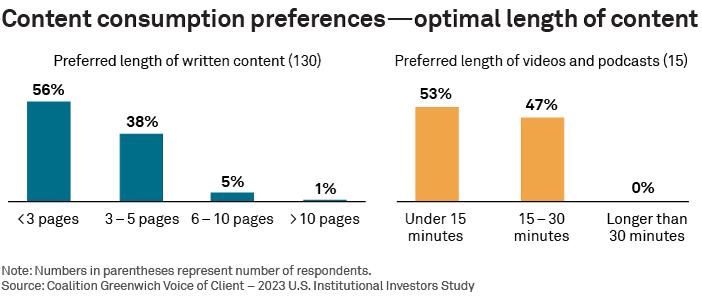

Get to the point, quickly

Finally, as our 10th-grade English teacher reminded us, "More Hemingway, less Faulkner." In other words, keep it concise. Investor Content Consumption: Without Data, It's Just Another Opinion shows that while about 80% of investors prefer written content, most want it no longer than five pages. Investors want non-written content just as succinct—about half prefer under 15 minutes. “Short and sweet” doesn't have to mean shallow. Market structure gets complicated quickly. Digestible content backed up by unique data and analysis is invaluable.

Bonus: Our favorite equities chart

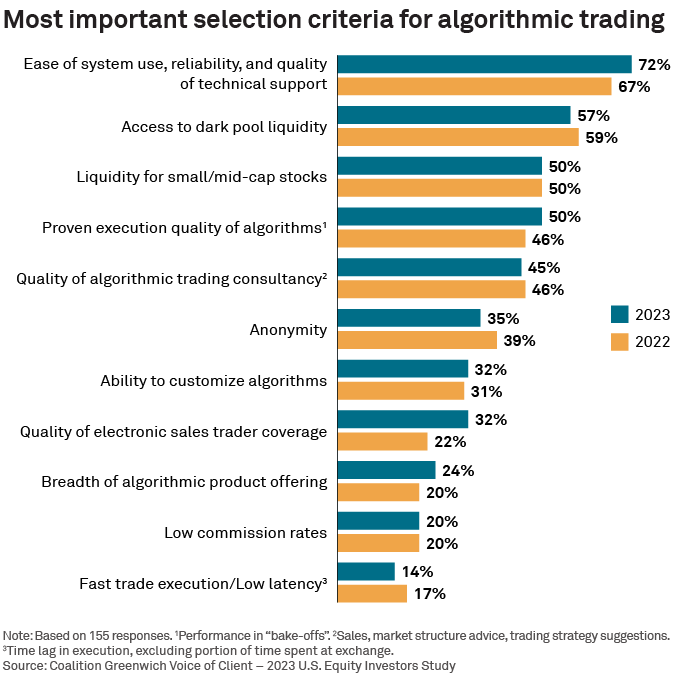

We couldn’t resist including our favorite equities chart of 2024, one of the first we published back in January, U.S. Equity Markets 2024: Trends and Opportunities. When it comes to selecting electronic trading providers, the buy side places the most importance on ease of use, reliability and high-quality support. This trifecta even scores higher than access to dark liquidity and proven execution quality.

Looking Ahead

Between the political and regulatory changes coming to the U.S., 2025 should be an interesting year for market structure across equities and beyond. Stay tuned as we continue to focus on the holistic, cross-asset trends, as firms adapt to navigate an increasingly competitive landscape.