A recent Coalition Greenwich study of asset managers revealed a surprising trend: 10% of them have paid trading commissions to outsourced trading (OT) platforms over the past year. This finding may raise eyebrows, as the buy side has traditionally been hesitant to admit to using such providers due to concerns about cannibalization and compatibility with best execution requirements.

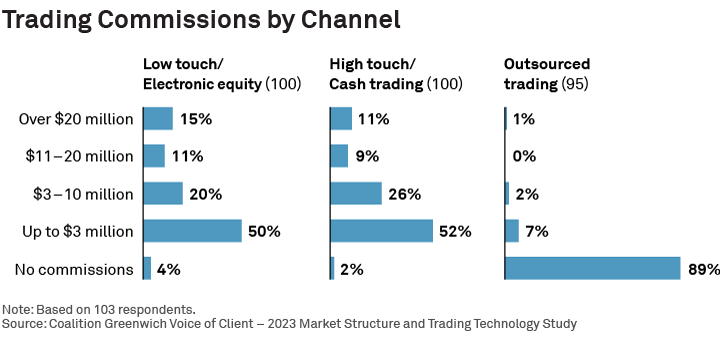

The study, based on responses from 103 buy-side equity traders globally in the fall of 2023, found that 7% of respondents paid commissions to OT providers ranging up to $3 million, while 3% paid more. This got us wondering: Has outsourced trading reached a tipping point where it's no longer a niche service but, instead, a mainstream solution in the spirit of workflow automation?

A Quickly Institutionalized Niche

What’s driving this acceptance? While OT was initially designed for emerging hedge funds, we've spoken to several large and well-established managers who have also embraced the idea. They use it to gain access to liquidity, research and market intelligence that they might not have internally or through their traditional sell-side providers. "We help them see what they don't see on their own," one outsourced representative told us.

This sentiment was echoed by a buy-side head trader, who praised the ability of outsourced providers to offer access to extra sell-side research that's out of reach directly. Their desk views outsourced providers as an execution broker who gives them access to desired research.

Of course, not everyone is convinced. Some OT providers took umbrage with the notion that they're providing research to non-paying clients. One independent outsourced head was particularly offended, stating they would never try to disintermediate brokers by distributing research to non-paying buy-side clients. “We’d be foolish to compromise a sell-side relationship.”, he added.

The concept of trading discretion often comes up when talking about OT. One buy-side head called it "the most perishable thing" and wondered how outsourced desks could preserve the flexibility of discretion the way only internal desks can. Other traders agreed, arguing only in-house traders, in continuous contact with their portfolio managers, can build real relationships and earn discretion around how they trade their orders.

Perhaps surprisingly, one outsourced trading executive agreed, saying they’d rather face off with an internal trader (rather than portfolio manager) who can shepherd investment information throughout the day to the investment team. “We become a lever and empower them, providing a path to information and liquidity.”

Expanding Choices

With over 40 firms claiming to offer OT services, the buy side is now faced with a daunting array of choices. It's an omnivore’s dilemma—many options may look appealing, but it's hard to know which one will truly satisfy their needs.

One provider noted their niche has become institutionalized, but that doesn't mean all platforms are created equal. Many newer entrants may struggle to gain traction—building relationships with the sell side takes time and effort. Several successful platforms pointed out that it's not just about having the budget for technology; it's about having the scale to hire top talent.

But there's a chicken-and-egg problem here, too. Providers need scale to attract and retain quality traders, but they can't offer competitive compensation without that scale. As one outsourced provider put it, "It's easy to say you're in the outsourced trading space, but it's incredibly hard to scale and succeed."

Jesse Forster is the author of this publication.