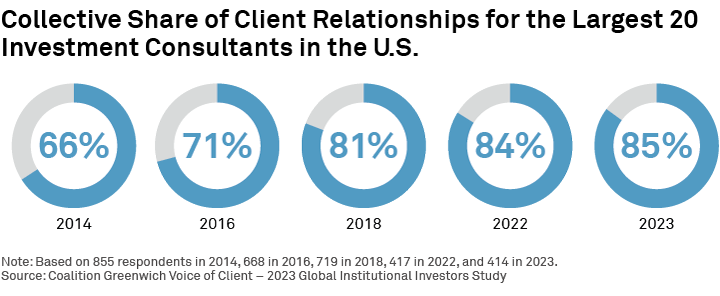

More than 85% of U.S. institutional investors work with an investment consultant—a usage rate that has been steadily ticking upward for the past five years. Investment consultants play a critical role as gatekeepers, influencing asset owners’ decisions on manager selection and allocation strategies. Their opinions and recommendations can substantially affect a manager’s reputation and market positioning. The Coalition Greenwich annual Investment Consultant Study captures insights from the most influential consultants in North America and the U.K. in order to understand how consultants evaluate asset managers, the criteria they prioritize and the factors that influence their recommendations.

Establishing strong relationships with investment consultants has become increasingly more complex and challenging, but asset managers rely on consultants to gain access to potential clients, receive feedback on strategies and enhance their market positioning. This symbiotic relationship is crucial to the success of both parties, as it facilitates informed decision-making and fosters long-term partnerships.

In 2023, we revisited our Investment Consultant Playbook, which outlines the key steps to achieving a winning relationship with investment consultants. It also outlines several dynamics that are reshaping the intermediary landscape and impacting relationships between asset managers and investment consultants. Below are three of the seven key challenges identified.

Growth of Outsourced Chief Investment Officer (OCIO)

The playing field has continued to evolve, with consultants, OCIO specialists and managers competing to an even greater extent. Regarding consultants, the growth, evolution and specialization of OCIO has required asset managers to decide how they fit into the model and to build relevant capabilities. In a number of cases, asset managers are competing directly with investment consultants for new business.

Institutionalization of the Intermediary Space

Large intermediary distributors are increasingly relying on consultants as the “institutionalization” of distributor practices continues apace. As consultants expand their sphere of influence, ensuring coordination with this channel will become increasingly important to maximize product placement.

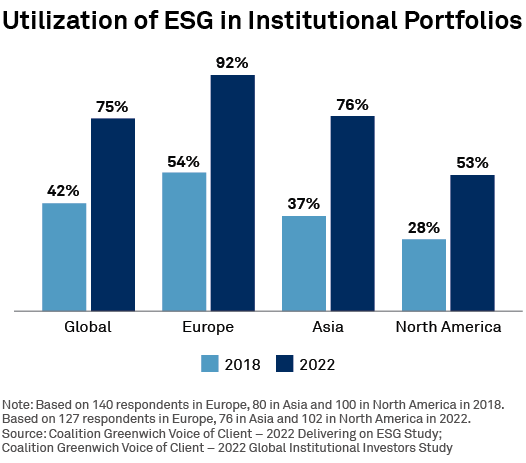

Emergence of ESG

As investors’ use of ESG has grown, consultants now often consider it a primary criterion in their evaluations and recommendations. As such, communicating best-in-class ESG capabilities and practices is often a cornerstone of sound consultant relationships. When working with consultants across multiple markets and in different regions (particularly between Europe and the U.S.), managers must show an extra level of dexterity. In addition, some consultants have set up their focus on ESG as a separate or dedicated practice.

Looking Ahead

Investment consultants will continue to play a crucial role in the asset management landscape. Asset managers must focus on building and maintaining strong relationships with consultants in order to succeed as the industry becomes more complex and competitive. By leveraging a deep understanding of consultant perspectives, managers can anticipate changing needs and objectives, identify best practices for strategic partnership, and ultimately, differentiate themselves with their effective coverage of this critical constituency.

Elizabeth McIvor is the author of this publication.