In an industry where innovation and strategic agility are critical, asset managers are increasingly focusing on product development and management as key drivers of growth. A recent Coalition Greenwich study, which gathered insights from 74 senior stakeholders from 68 asset management firms globally, sheds light on how firms are navigating the current product landscape.

1. The Growing Dominance of Private Markets

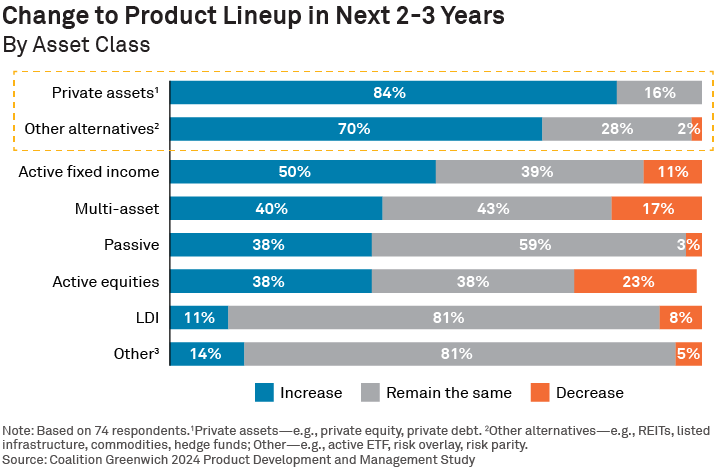

One of the most striking findings is the robust expansion of private markets within asset managers' product line-ups. Over the past few years, private assets have seen the greatest growth, with 82% of managers reporting an increase in their private asset offerings. This trend is expected to continue, with 84% of managers predicting further expansion in this asset class over the next few years.

The growing focus on private markets reflects the increasing demand for alternative investments, with managers not just adding private assets to their portfolios but also confident about their future prospects, viewing them as a core component of their growth strategies. This confidence contrasts with the more tempered expectations for traditional active equities, where only 46% of managers reported an increase, and 26% actually decreased their offerings. This shift underscores the broader industry trend toward alternative assets as a key growth area.

2. Strategic Focus on Expanding Existing Capabilities

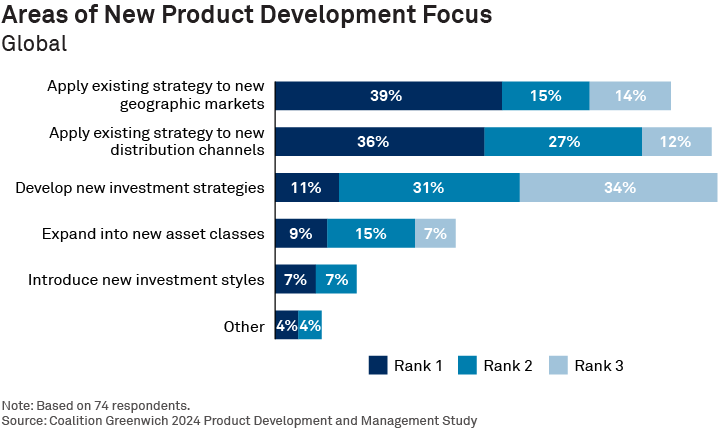

Managers seem to be placing an emphasis on leveraging existing strategies to drive product development. Rather than pursuing entirely new product categories, asset managers are primarily focused on applying their established strategies to new geographies and distribution channels. This approach not only mitigates risk but also allows firms to capitalize on their existing expertise and brand reputation.

Thirty-nine percent of managers ranked the application of existing strategies to new geographic markets as their top priority in product development. Similarly, 36% prioritized expanding into new distribution channels, indicating a clear preference for building on what they already do well.

This strategic focus on expansion rather than innovation suggests that asset managers are seeking steady, incremental growth. By extending their existing capabilities into new markets, firms can achieve scalability and tap into new revenue streams without the uncertainties associated with launching completely new products.

3. Dedicated Product Teams

The study also highlights the importance of dedicated product resources to oversee the complexities of product development and management. Nearly 59% of managers have a single team or group overseeing these functions, with larger firms being more likely to have such dedicated teams. This centralized approach ensures a more coordinated and strategic effort in product management, with a wide range of business functions represented in the process.

Dedicated product teams are crucial in a rapidly evolving market where agility and responsiveness are key. These teams not only oversee the development of new products but also monitor existing products' performance, ensuring that they continue to meet client needs and remain competitive.

The trend toward dedicated product teams underscores the growing complexity of product management in the asset management industry. With firms increasingly focusing on a broader array of products, noted by the rise in private markets, having a specialized team ensures that product strategies are aligned with broader business goals and market demands.

The growing focus on private markets, the strategic expansion of existing capabilities, and the rise of dedicated product teams reflect an industry that is adapting to new market realities while building on its strengths.