The alternative funds market is gaining ground in Asia among a select retail banking segment, with bank-led distributors playing a pivotal role in shaping the future of this segment. A recent Coalition Greenwich study sheds light on key trends within the sector, revealing evolving preferences among distributors, increasing manager rosters and a greater emphasis on education and expertise.

1. Growing Demand for Alternatives, Led by Private Banks

The adoption of alternative funds is surging across Asia, driven primarily by private banks. A significant 54% of bank-led distributors already offer alternatives on their platforms, with this number rising to 73% for private banks, compared to 46% for retail banks. Singapore leads the region with an impressive 82% adoption rate.

Private banks are notably more aggressive in this space, allocating 13.6% of assets under distribution (AUD) to alternatives, versus 4.7% among retail banks. The higher adoption rate among private banks reflects a deeper engagement with high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), who are increasingly sophisticated and eager for more diversified investment options like hedge funds, real estate debt and private equity. This deeper engagement from private banks expands to family offices as well—a rapidly growing segment in the region and natural extension of the UHNW space.

This rising demand underscores the need for managers to refine their offerings and cater to the growing appetite for alternatives, particularly in wealth hubs like Singapore and Hong Kong.

2. Rising Manager Rosters and Focus on Private Debt

One of the most striking findings is that 52% of bank-led distributors expect to expand their manager rosters in the next three years. Private debt is predicted to be a standout asset class, with 64% of intermediaries planning to add managers in this space. Hedge funds and private equity are also high on the list, but the focus on private debt highlights a shift toward income-generating, low-volatility alternatives, especially as market conditions remain uncertain and volatile.

As funds become more concentrated with top-ranked managers, the expected roster expansion reflects a desire for greater diversification and access to specialized expertise. In markets like Malaysia (83%) and Singapore (70%), expectations for roster growth are particularly high, signalling increasing competition for fund managers to secure their position within these regions.

3. Track Record, Training and Education are Crucial to Manager Selection

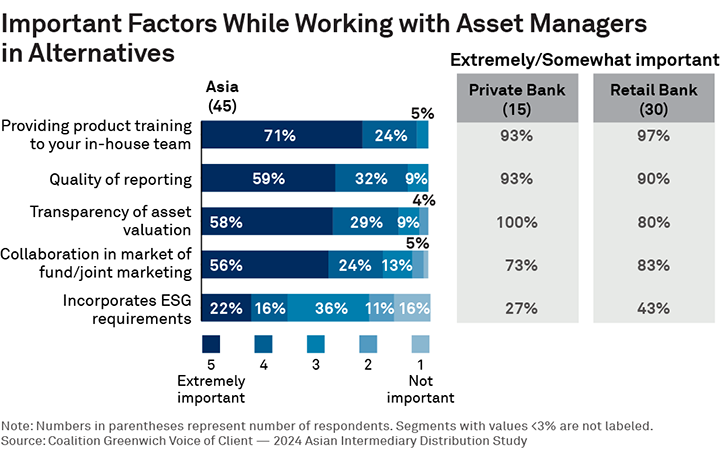

When it comes to choosing alternatives managers, distributors prioritize track record and global expertise. Seventy-two percent of respondents cited a robust track record as the most important factor, followed by global expertise in specific asset classes (55%). However, distributors place a growing emphasis on manager-led training programs for in-house teams, particularly among private banks. Nearly all private banks (93%) and retail banks (97%) indicated that training provision is a critical factor.

Education remains a major barrier to greater adoption of alternatives. Distributors point to a lack of understanding among both sales teams and clients hindering the promotion of alternatives, especially for complex products. As a result, the need for comprehensive education programs, both internally and for the underlying investors, is essential to drive broader acceptance and investment in alternatives.

In conclusion, as the alternatives market expands in Asia, the key to success lies in providing a strong track record, specialized expertise and continuous education. Fund managers that prioritize these attributes will be well-positioned to capture the growing demand among private and retail bank clients across the region.