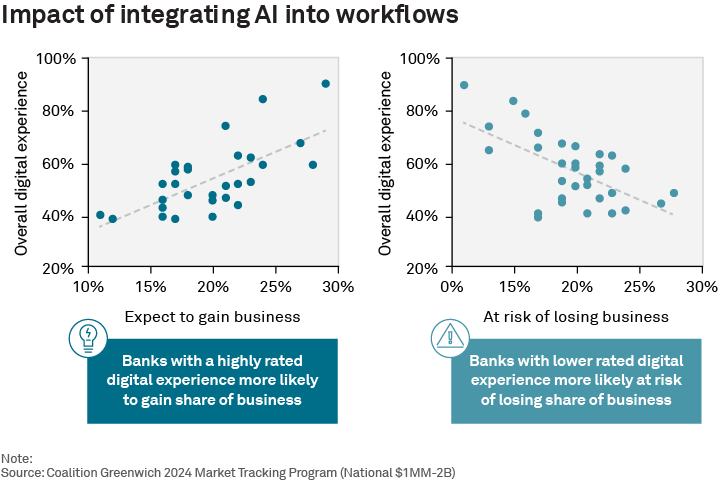

It’s hard to overstate the impact artificial intelligence is having on the banking industry. Technology has already become a primary driver of business results for corporate and commercial banks and a centerpiece of client relationships. Going forward, banks’ ability to integrate AI into workflows will increasingly help determine their ability to attract and retain corporate banking clients and to maintain and grow revenues and profits.

We believe the future of corporate and commercial banking will take the form of blended digital/RM-managed client portfolios. Pairing RMs with AI-driven portfolio and client-management tools will result in a new coverage model that radically enhances existing capabilities. AI will make bank staff more effective in their client interactions by customizing presentations, generating personalized insights and recommendations, and recommending solutions tailored to individual clients.

For banks, building these integrated digital/RM models will require sizable investments and careful integration. For bankers, one of the most critical elements for success going forward will be an openness to adopting new AI tools and a willingness to embrace these new coverage models. In order to seize that opportunity, bankers and product managers will first need to develop a broad knowledge of how AI works, how it’s evolving, and how it’s being applied today in corporate banking.

The AI Evolution

In the early 2000s, banks and other companies began using an emerging technology called intelligent automation to automate low-level tasks. Soon thereafter companies in all industries began experimenting with an even more powerful technology called machine learning (ML), in which models learn from data patterns and improve their own performance over time.

One of the most transformative moments in AI evolution came in November 2022, when OpenAI debuted ChatGPT and attracted some 100 million users in less than three months. ChatGPT is an example of generative AI, which can produce “original” content in the form of images, video, and text.

The next generation of AI is “general AI,” or software that can process information and learn at a level comparable to human cognitive abilities. There is considerable debate about when general AI will arrive, with predictions ranging from a few years from now to decades in the future. In the meantime, companies are heavily investing in agentic AI, or artificial intelligence applications capable of acting autonomously to accomplish goals.

AI in Banking: Real-Life Use Cases

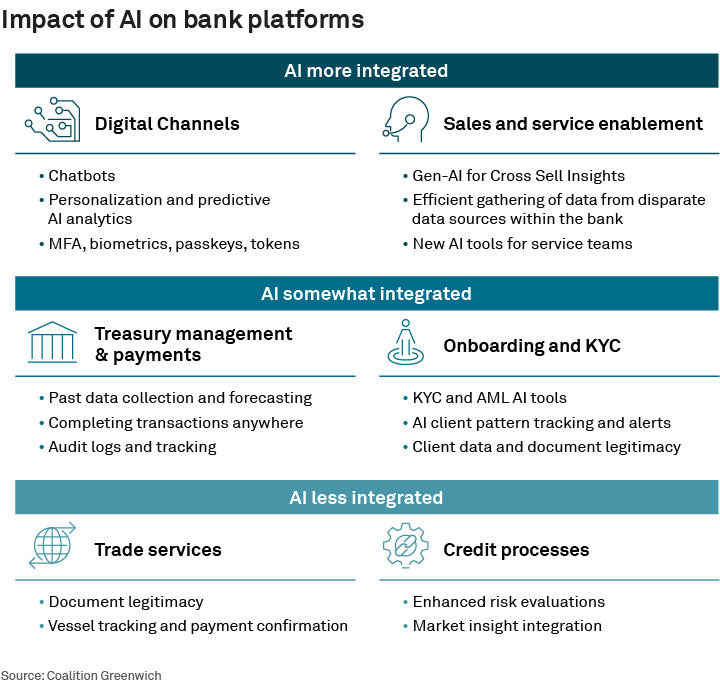

Throughout this evolution, banks have applied the latest technology to solve problems with real-life use cases. Through our Digital Transformation Benchmarking study, we’ve noticed that front-office applications have received most of the early attention and investment, as banks use AI to enhance client communications and help bankers do their jobs more effectively. The graphic below shows some of the AI use cases currently having an impact with live uses cases in bank platforms.

In the future, AI use cases will become more widespread and impactful. Banks, Fintechs, and Third-Party Platform Providers are already deploying servicing chatbots that instantly answer questions for clients and will eventually be capable of resolving many basic client issues autonomously.

AI will also provide the basis for more sophisticated advisory services, utilizing things like detailed analysis of merchant services data, improved Cash Flow Forecasting models, and highly advanced risk forecasting to help clients optimize balance sheets and improve business results. With widespread and impactful use of AI expected to continue to accelerate in the future, the banking industry is transforming the way they operate, interact with customers, and drive business results.

Amos Welder, Relationship Director—Corporate Commercial Banking, and Kassie Krivo, Senior Relationship Manager—Corporate Banking, are the authors of this publication.