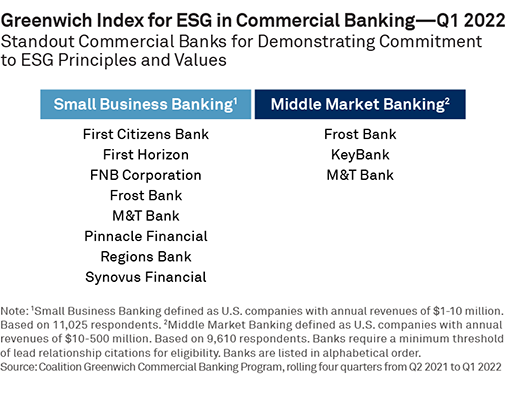

More than a quarter of U.S. small and mid-sized businesses say they are likely to choose a bank that demonstrates a commitment to ESG the next time they add or switch providers. That’s good news for the nine banks named by Coalition Greenwich as Standout Commercial Banks for Demonstrated Commitment to ESG Principles and Values.

The Q2 2022 Greenwich Market Pulse reveals a sharp decline in economic sentiment among owners and executives of small businesses and middle-market companies. Respondents cite inflation, increasing debt, staffing concerns, supply chain issues, and the war in Ukraine as the main reasons for their declining optimism. The Greenwich Market Pulse also asked businesses about digital currencies and the transition from Libor to SOFR.

MethodologyGreenwich Market Pulse: An ongoing research series that addresses the most important and timely issues facing small and mid-sized ($1- 500MM) company executives and their banking relationships. Our access to thousands of financial decision-makers in the United States allows for constant contact with the market. Greenwich Market Pulse reports deliver the unbiased perspectives of these individuals in concise and actionable charts, complemented by insights and analysis from our industry experts. Greenwich Market Pulse studies are conducted four times per year and are often used in tandem with other annual research.

218 companies were interviewed online in March and April 2022, representing 98 small businesses ($1 - 10 million) and 120 mid-sized companies ($10 - $500).