Table of Contents

Small and midsize companies as well as the commercial banks that serve them are bullish about markets and the economy for 2025. In this report, we identify the top trends to watch in U.S. commercial banking in a year that seems to be starting out with the potential for strong growth and game-changing innovation.

A new chapter

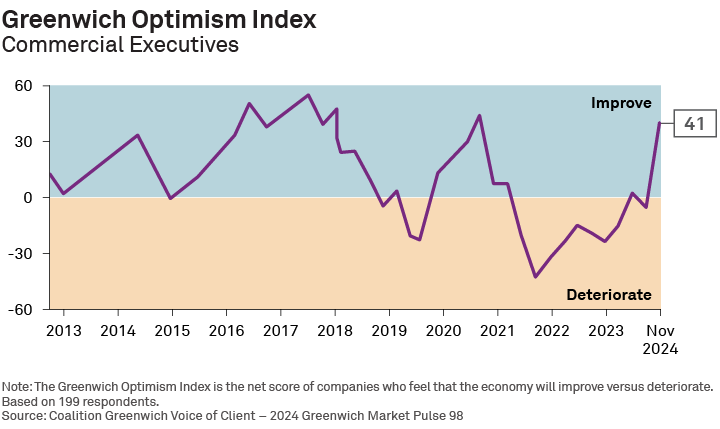

In the second half of 2024, economic optimism among U.S. companies experienced the biggest jump we have measured in at least a decade. A combination of rate cuts, moderating inflation, expectations for more Fed easing, a vibrant stock market, and the prospect of a presumably more business-friendly White House administration has unleashed the animal spirits of business owners and executives.

The Greenwich Optimism Index started Q3 2024 in negative territory at a score of -4, meaning that a slight majority of the business owners and executives taking part in our quarterly Market Pulse study expected the economy to contract going forward. By the start of Q4 2024, the Index score skyrocketed to +40—the largest and fastest increase we’ve seen since we launched the Index more than 10 years ago.

An Index reading at that level suggests that U.S. companies are expecting growth, including cheaper funding costs and increased investment in their businesses. Bankers largely agree with this outlook: Two-thirds of U.S. bankers polled expect demand for loans to increase in the next 12 months. At this point, it seems the only thing to worry about is that everyone is so positive—something that can lead to a bubble.

New loans, new competition

Although multiple signs point to increased loan growth, the concerning news for banks is that they might win a smaller share of that new business in the year ahead. Data from Crisil Coalition Greenwich research shows that nearly a quarter of middle market companies and 16% of small businesses are planning to seek out funding from non-traditional lenders.

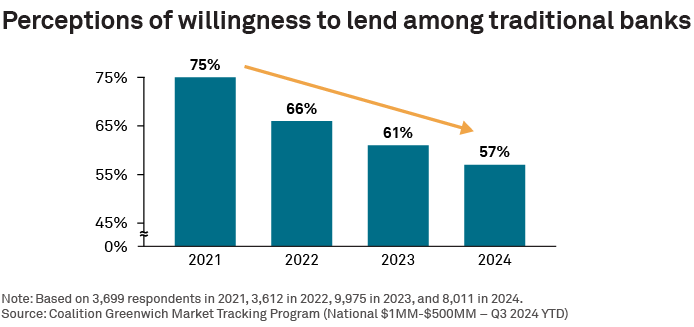

Business owners and executives are looking for new alternatives in part because they are frustrated by traditional bank credit policies. Companies’ ratings of their banks’ credit willingness to lend have dropped steeply and steadily since 2021. Although 2025 is shaping up to be a strong year for loan demand, that negative shift in how business owners and executives view bank lending could emerge as a meaningful drag on loan growth for banks and a significant boost to non-traditional lenders.

The big just keep getting bigger

With the economy and financial markets seemingly firing on all cylinders, bank deposits appear on course for strong growth in 2025. For better or worse, it’s possible that many of those new deposits will find their way to the four biggest U.S. banks. Crisil Coalition Greenwich research suggests the 2023 banking crisis did lasting damage to the perception of safety at smaller banks.

Every year, we ask the small businesses and midsize companies participating in our research to rate the level of trust they have in their banks. Since 2023, there has been a steady decline in trust ratings for community banks, regional banks and even super-regionals. The glaring exception: the big national banks that business owners and executives see as “safe.” To compete against these large institutions in the war for deposits, smaller banks in 2025 will have to hone their messaging and execution to convince commercial clients that they are financially stable, easy to do business with and worthy of their trust.

Companies accept (and some prefer) digital

Digital self-service has come into its own in commercial banking. Retail consumers took to online banking almost immediately as a way to eliminate trips to the branch and frustrating experiences with call centers. Small businesses and middle market companies that rely on bank relationship managers (RMs) and branch personnel for a broader range of needs and services were much slower to embrace the benefits of digital banking. That all changed with the COVID-19 pandemic.

After the pandemic, leading banks’ digital features and functionality were much improved, and companies became much more comfortable with self-service. As a result of those interconnected trends, client satisfaction with bank self-service offerings has improved from 44% in 2022 to 52% in 2024.

Of course, not everyone is equally impressed. As one might expect, younger business owners and executives are much more inclined than their older counterparts to opt for digital self-service as their primary service model, while older professionals are more likely than the younger generation to prefer working with an RM. In 2025, look for some smart banks to try to differentiate themselves by targeting companies led by Gen Z and millennial executives with slick new digital offerings.

The 2025 word of the year in banking: Integration

Substantial investments in banks’ digital platforms aren’t always delivering the expected client experience. One of the main reasons results have fallen short of projections is that some clients are having a hard time integrating banks’ digital offerings with their own technology infrastructure. Integration headaches are becoming a bigger issue for companies that rely on their own internal platforms for more essential functions, and that now rank “ease of integration” as a top three criterion when allocating new business to banks.

In the year ahead, banks will try to address this issue from the technology side by improving platform connectivity with APIs and other technology, upgrading development portals to make them more flexible for clients, and partnering with third-party technology consultants. Meanwhile, banks will be deploying specialized experts to educate clients about available technology, help clients integrate and access digital tools, and make sure clients are getting the absolute maximum benefit from banks’ online offerings.

Banks will be incentivizing bankers and customer support teams to achieve the same goals. Marketing campaigns launched by banks will be designed to present their institution as sophisticated and seamless technology partners for both commercial banking clients and fintechs alike.

Cutting through the hype on AI

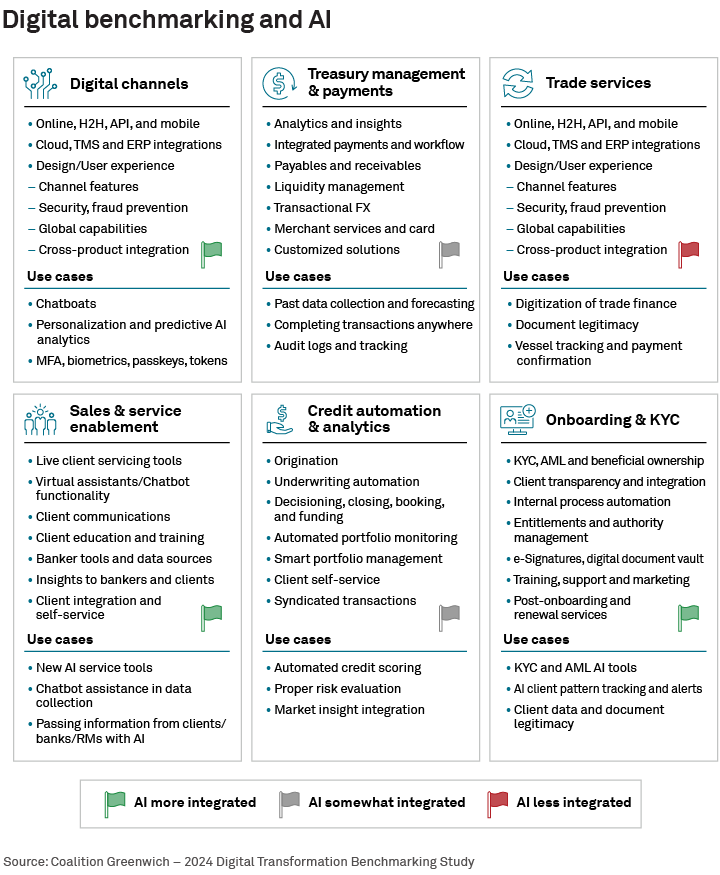

No list of trends and predictions for 2025 can be complete without addressing artificial intelligence (AI), especially as new AI models like DeepSeek launch in the marketplace. Instead of presenting yet another observation that AI will “transform the industry” in the coming year, we thought we’d do something more constructive: identify the areas where AI is already having an impact and point out the real-life use cases that banks will deploy in the year ahead.

The figure below breaks down some of the core functions that make up a commercial banking relationship and rates each based on the extent to which AI is being used by banks. Green flags mean AI use is always common; red flags mean that banks have yet to significantly deploy AI due to practical limitations, risk concerns or regulation. For each function, we identify the main use cases that will be available to banks and clients in 2025.

Merchant analytics expand bank relationships

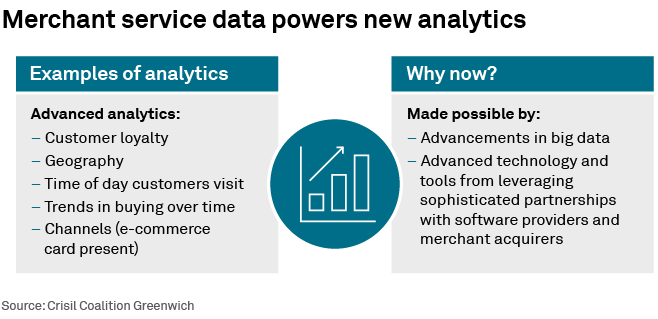

In 2025, commercial banks will deploy powerful merchant analytics platforms to deepen client relationships, expand engagements to new stakeholders inside client organizations and, potentially, create a new source of revenues. Banks are using new analytic capabilities and AI to leverage their massive trove of data on their clients’ businesses and customers. Drawing on data on consumer purchasing patterns, banks are generating insights about their clients’ customers’ spending choices and behaviors. Relationship managers are using these insights to advise restaurants, retailers and other clients not just on their banking needs, but on business strategy.

That type of consulting service is deepening existing relationships with CFOs and treasury professionals while also creating new ties into marketing teams and other parts of the client organization. In coming months, merchant analytics could also emerge as a promising new source of revenue as banks start to charge for the service (see the following trend).

Welcome to the age of premium pricing

In 2025, banks will become more comfortable charging clients for analytics and other digital capabilities that they had been giving away for free. Banks traditionally have used technology in two main ways: 1) to build efficiencies and lower costs internally, and 2) to enhance customer service and the customer experience—at no direct cost to the client—in order to win new banking clients and retain existing business. As banks invested to create increasingly powerful analytics, some tried to position themselves as premium providers and started charging higher core liquidity and banking fees for the bundled package, including new technology offerings.

In the coming year, some banks will go a step farther by charging directly for their analytics and other insights. Some banks have started already by offering layered tiers of service, with standard analytics included for free at the basic level, and more powerful analytics and other innovative tools available only to clients willing to pay extra. Watch for even more sophisticated pricing models to emerge as banks begin charging a per-click fee for things like APIs and other advanced digital features.

Cheri Derrick, Chris McDonnell, Don Raftery, Kevin Seiler, and Amos Welder advise our commercial banking clients in the United States.