After seeing declines in the volume of structured products distributed to retail and high net worth individuals last year, volumes in 2018 increased to just over $48 billion (annualized). This...

Good customer experience is easy to recognize but can be difficult to deliver.

For that reason, Greenwich Associates is launching the Greenwich CX Leaders—an award recognizing leadership...

Announcing the 2018 Greenwich Excellence Awards for Large Corporate Trade Finance... More than 270 banks were evaluated and six had distinctive quality...

Around the world, large companies express strong concerns about the risk posed by trade wars and other potential events. In fact, of all the challenges and opportunities that may have an impact...

The U.S. corporate banking market is on the cusp of a revolution, with relationship strength and wallet allocation increasingly driven by effective process digitization.

For much of the past...

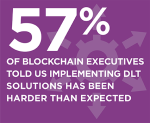

Earlier this year, Greenwich Associates released research looking at the current state of enterprise blockchain adoption in capital markets1. The study found distributed ledger technology (DLT)...

Announcing the 2018 Greenwich Excellence Awards for U.S. Large Corporate Finance... More than 70 banks were evaluated and seven had distinctive quality.

Explicit unbundling of research/advisory payment and “best execution” moved to the fore after MiFID II’s implementation in January 2018.

In post-MiFID II initial reviews in Q2 with European...

Fixed-income dealers that invested in their businesses over the past year are positioning themselves to capitalize on an anticipated pickup in market volatility and investor activity. Based on Q2...

For many years, Canada’s fixed-income dealers have pursued RBC Capital Markets, which has maintained a dominant position as the country’s No. 1 dealer with Canadian investors.

Over the past 12...