Several disruptions over the past years in both the U.S. Treasury and repo markets have inspired the U.S. Securities and Exchange Commission (SEC) to take a closer look at trading dynamics and...

In this report, we examine the role that investment research/content plays in the institutional investment landscape and how that role has changed in the past five years. In today’s new normal,...

Large companies are asking their banks for advisory services, enhanced customer service and improvements in ease of doing business to help them sustain and grow their businesses amid increasing...

FY22 Coalition Index Investment Banking revenues fell (13)% on a YoY basis.

IBD: Shrinking M&A pipeline and declining origination led to the lowest revenue in a decade (following a strong...

FY22 revenues for the Commercial Banking Index banks increased significantly YoY, driven primarily by Cash Management which was supported by an increase in Trade Finance and Lending. This was...

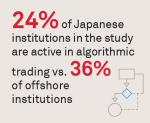

In 2022, inflation, rising interest rates and other macroeconomic headwinds replaced pandemic disruptions as the key challenges facing institutional investors in Japanese equity markets.

Many...

This Greenwich Report explores several drivers of investment in surveillance technology. These range from the system upgrades via new technology, better data, more analysis tools and methods, and...

Transaction Banking Revenues reached a decade high in FY22, driven by robust growth in Cash Management, while Trade Finance grew moderately. The second half performed better than first half,...

Despite economic headwinds around the world, large companies in the Middle East and North Africa remain extremely positive in their outlook, with attention and resources focused on expanding and...

Environmental, Social and Governance (ESG) is one of the more ubiquitous topics in asset management, yet inconsistencies around taxonomies, data and regulation impact the investment process....