Based on interviews with 46 bond dealers in the U.S. and Europe, this study examines the differences in how bulge bracket and regional dealers are adapting to the post-crisis market structure. The...

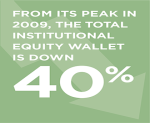

Since 2009, U.S. equities have been on a tear, with the S&P 500 increasing by 3.5 times. Against this backdrop, one might expect U.S. brokers to have benefited handsomely from the equity bull...

In 2015 Greenwich Associates research found that the top five FX dealers, while still dominant, were ceding market share to regional and smaller firms. This shift was driven predominantly by top-...

Execution algorithms have become popular for foreign-exchange (FX) trading in recent years, driven by strong uptake among hedge funds, market makers and speculators. Not wanting to be left out of...

Approximately 60% of Indian middle-market companies expect the implementation of the national Goods and Services Tax to have a positive impact on their businesses.

The government of India...

The Markets in Financial Instruments Directives II (MiFID II) is scheduled to go into effect in January 2018. Much of the discussion and debate so far has focused on the new requirements...

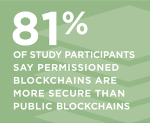

About three years ago, the financial services sector seriously began exploring blockchain—the distributed ledger technology (DLT) behind bitcoin—for processing financial services transactions. The...

The buy side can’t live without their order and execution management systems and increasingly are looking outside to gain access to the latest and greatest platforms on the market.

Building...

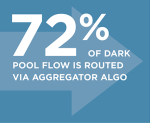

Recent revelations of impropriety at certain dark pools have made traders more diligent in assessing the design, liquidity and protections offered by competing venues.

In certain cases, these...

The biggest conundrum facing both the buy and sell side in light of MiFID II is how to put a value on research.

Currently, most buy-side firms use the traditional broker vote, which arms...