For institutional traders, the original “set and forget” approach to e-trading has been supplanted by a purposeful, spasmodic style where orders are released for a few minutes and then cancelled when they appear to be impactful.

As a result, block and algorithmic trading are no longer separate endeavors.

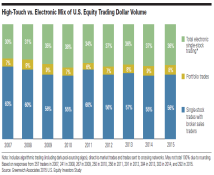

The growth and adaptation of low-touch trading has strongly influenced the roles and capabilities of institutions and their brokerage counterparts.

Sales traders who embrace this change and acclimate themselves to the value of execution consultancy are likely to take the pole position.

Methodology

Greenwich Associates conducted in-person and telephone interviews regarding U.S. equity investing with 243 U.S. equity portfolio managers and 321 U.S. equity traders between November 2014 and February 2015. Respondents answered a series of qualitative and quantitative questions about the brokers they use and their businesses in the U.S. cash equity space.

The data reported in this document reflect solely the views reported to Greenwich Associates by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results. Unless otherwise indicated, any opinions or market observations made are strictly our own.

© 2015 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.