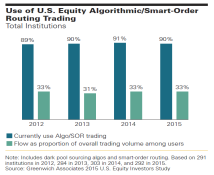

While e-trading has gained mainstream acceptance, institutional volumes have stalled with only a third of buy-side trader’s flow executing via low-touch strategies.

As the choice of e-trading offerings continues to grow, so does the complexity of U.S. market structure. The net effect is essentially a standoff.

The buy side wants simplicity. Ease of use, reliability and quality of support drive e-trading selection.

Currently, order flow is concentrated to a small number of brokers. For e-trading usage to be more rational, the sell side needs to streamline their electronic offerings to combat market complexity and align with institutional needs.

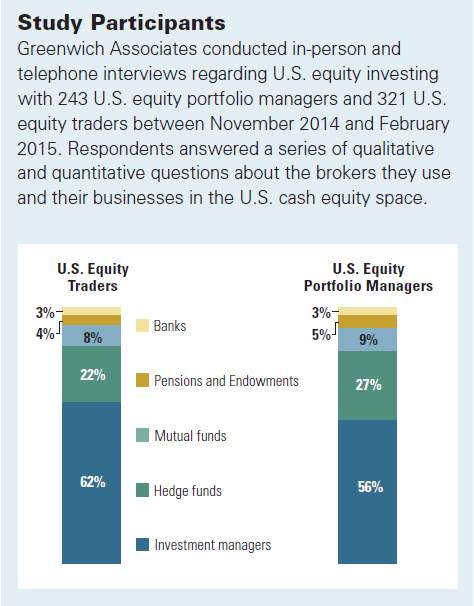

Methodology

Greenwich Associates conducted in-person and telephone interviews regarding U.S. equity investing with 243 U.S. equity portfolio managers and 321 U.S. equity traders between November 2014 and February 2015. Respondents answered a series of qualitative and quantitative questions about the brokers they use and their businesses in the U.S. cash equity space.

The data reported in this document reflect solely the views reported to Greenwich Associates by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results. Unless otherwise indicated, any opinions or market observations made are strictly our own.