Executive Summary

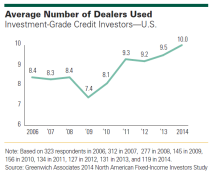

While the U.S. corporate bond market continues to be dominated by the top dealers, Greenwich Associates data suggests that institutional investors are beginning to explore new liquidity providers in the secondary market.

Electronic trading of odd-lots will continue to grow, with the potential to take the marketwide percentage of volume traded electronically to 20% by 2016.

Methodology

Between February and April 2014, Greenwich Associates interviewed 1,067 U.S. institutional investors active in fixed income. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.