Total notional volumes for retail structured products distributed by U.S. firms remain at over $54 billion annually. Products based on equity underlyings continue to account for the...

Nearly 80% of the over 200 European investors we spoke with for the Greenwich Associates 2015 European Fixed-Income Study confirmed their trading protocol of choice was the phone, with...

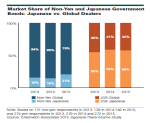

A dearth of client trading activity in Japanese government bonds has triggered a push by the country’s largest domestic fixed-income dealers into non-yen products, particularly non-yen...

Insights from Greenwich Associates' 2015 Large Corporate Finance Study, includes Corporate Treasury Compensation information, market trends and top issues facing U.S. Corporate Treasuries.

Market Trend data from Greenwich Associates' 2015 Total United States Debt Capital Markets study.

Market Trend data from Greenwich Associates' 2015 Canadian Large Corporate Trade Finance study.

Market Trend data from Greenwich Associates' 2015 Canadian Investment Banking study.

Market Trend data from Greenwich Associates' 2015 Total Canada Large Corporate Cash Management study.

Greenwich Associates spotlights the top 10 market structure trends in the year ahead.

With the U.S. Federal Reserve finally raising rates and dates for mandated clearing in Europe set, a number of...

This report provides detailed information from Asia ex-Japan-based investors investing in equity derivatives, including helpful benchmark data such as:

Product usage

Important selection...

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation