This report covers a wide array of topics like key challenges facing institutional investors, trends on funding levels, attributes impacting manager selection, differentiators of strategic partner...

Alternative Funds are becoming an integral part of Intermediary portfolios. As investors become more sophisticated, managers must continuously assess their offering to stand out from the crowd....

The U.S. fixed-income market has seen renewed excitement and an increase in interest in the past two years, following aggressive interest rate hikes by the Federal Reserve. Retail and...

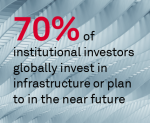

This report covers the latest trends in infrastructure investing based on feedback with influential asset owners. Coalition Greenwich gathered their views of the current infrastructure landscape,...

The goal of any buy-side trader is to achieve best execution. For FX traders, transaction cost analysis (TCA) and other similar tools are making it easier to measure not only the buy-side trader’...

October 31st was the most active day in U.S. Treasury market history, with $1.54 trillion of volume traded. While month-end volume spikes are nothing new, the activity capped off a month of...

The October corporate bond market felt calm compared to the record-breaking September (2024), with market volume, e-trading and new issuance metrics down month-over-month. A year-over-year comparison...

View asset managers in the United States most frequently recommended to institutional investors across asset class and product category. Results are based on conversations with leading investment...

View asset managers in Canada most frequently recommended to institutional investors across asset class and product category. Results are based on conversations with leading investment consulting...

Convertible bonds combine elements of bonds, stocks and derivatives, making them a unique asset class. Electronic trading has transformed the convertible bond market, driving improved execution...

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation