This report provides detailed information from Asia-based fixed income investors including helpful benchmark data such as:

Dealer rankings

Trading volume breakdown

Electronic trading...

FICC: FICC revenues declined by (16)% YoY due to lower volumes across products as spreads tightened and volatility remained muted. Decline in FICC revenues was mainly driven by Macro products in both...

Holistic surveillance practices have evolved significantly in recent years, and never more so than during the industry’s historic transition to remote working environments in 2020. Effective...

Late-month volatility in the credit market, linked back to variant and accelerated tapering news, did little for corporate bond volumes in November. Average daily volume in November was down 9% from...

U.S. Treasury markets ended November digesting news of a new COVID variant and surprisingly hawkish comments from Chairman Powell about a potentially early end to Fed bond buying. This drove market...

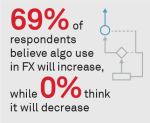

The use of algorithms in foreign exchange (FX) execution remains less prevalent than in equities. Market practices change over time, of course, and disruptions such as the pandemic then...

In its early days, alt data for investment and trading decisions was procured separately from traditional market data. Today, traditional financial information vendors and aggregators have...

This report provides detailed information on European trade finance, including insights from corporate treasury professionals on digital adoption, selection criteria for choosing trade finance...

A lot has happened since the beginning of 2020, including the growth of electronic trading in nearly every major asset class around the world. Coalition Greenwich interviews roughly 4,000...

Despite an active U.S. Treasury market and more interest-rate volatility than we’ve seen in months, U.S. corporate bond markets remained relatively calm, with October volumes 6% lower than they were...

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation