This report provides detailed information from Asia-based corporate interest-rate derivatives users.

New

While market volatility has continued to be a dominating issue for investors, soaring inflation in recent years and central bank interventions have created new challenges. As interest rates have...

New

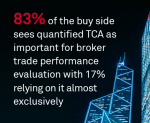

Transaction cost analysis (TCA) stands at the cornerstone of institutional equity trading, a quantitative tool to evaluate the impact of various execution decisions on both implicit and explicit...

New

Institutional investors are increasing their proportion of spending on Japanese equity research in the face of a long-awaited surge in Japanese stocks. That’s welcome news for Japanese brokers...

New

Over the past three years, leveraged loan markets have been on the same roller coaster as the rest of the fixed-income market. The mostly floating rate market was a port in the storm as interest...

New data on bank commercial and industrial (C&I) lending shows just how tenuous the situation is for companies and for the overall economy as the world waits to see whether the U.S. Federal...

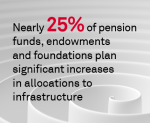

Investors remain focused on issues of liability and risk management; however a quarter of investors are concerned about liquidity, up from 10% in 2021, while the issue of integrating ESG has...

European corporates are consolidating their banking business with key relationships that provide superior service quality, robust digital platforms and a comprehensive international offering. As...

Traditional asset managers could face an increasingly challenging marketplace in Japan as asset owners slow expectations for manager hiring and shift allocations in the direction of alternative...

March 2020 was the highest volume month in the history of the U.S. Treasury market with the average daily notional volume (ADNV) hitting $944 billion.

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation