Institutional Investors Turning to Fixed-Income ETFs in Evolving Bond Market

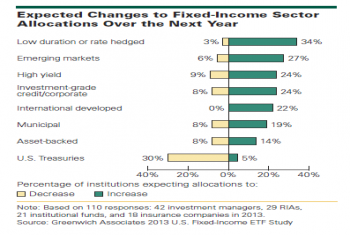

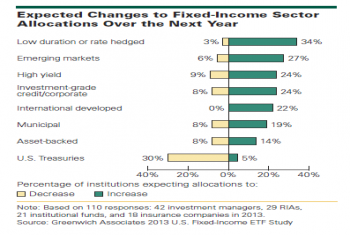

Fixed-income exchange-traded funds (ETFs) are poised to take on a bigger role in institutional portfolios.

Fixed-income exchange-traded funds (ETFs) are poised to take on a bigger role in institutional portfolios.

New focus on retail structured products heightens competition among banks. J.P. Morgan leads in U.S. while Société Générale leads in Europe...

OTC derivatives volume decreased in 2013.

Electronic trading systems increased their share of global fixed-income trading volume in only slightly in 2013, bringing the proportion of total volume executed electronically to 25%. Top fixed-income e-trading platform players continue to...

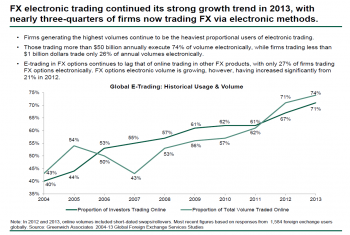

As strong growth continues in FX e-trading, regulatory changes and algorithm usage are driving some users back to single-dealer platforms.

Mizuho Securities and SMBC Nikko Securities each gained four percentage points or more of vote share in Japanese equity research and advisory services during in 12-month period...

The Asian equity market is attracting fierce competition from a large and diverse group of brokers looking to capture a share of the region’s recovering institutional research and trading business.

Trading volume increased in 2013.

Although Asian banks have been capturing large corporate clients from European rivals, the latest research from Greenwich Associates shows that HSBC has established itself as the leading bank in the region in terms of both number of relationships...

BNP Paribas has established itself atop the European corporate banking market by securing relationships with 56% of the largest European companies.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder