Fixed Income EMS Adoption Nascent but Evolving Fast

As adoption of fixed income execution management systems (EMSs) spreads among buy-side firms, the use cases are evolving and the benefits are also accruing beyond the trading desk, pointed out the participants at a recent Coalition Greenwich webinar titled “Adopting a Fixed Income EMS: Exploring the Journey from Adoption to Application.” The webinar was hosted by Audrey Costabile, Head of Risk and Financial Markets Regulation, Coalition Greenwich.

“Fixed income EMSs address evolving workflows in the asset class. They provide traders with a centralized view of all sources of liquidity, flexibility and trading protocols, and move the buy side closer to the portfolio trading, automated market-making and ETF ecosystem,” stated Dwayne Middleton, Global Head of Fixed Income Trading, T. Rowe Price.

The Case for EMSs

Although fixed income EMS adoption is relatively new, the case for it is strengthening. “We started this journey to minimize the number of platforms people needed to log into and aggregate things,” said Andrew Claeys, Head of Systematic Trading, Allspring Global Investments. Apart from enhancing trading desk efficiencies, “we needed to scale up the business and keep traders’ concentration on the things that can't be automated.”

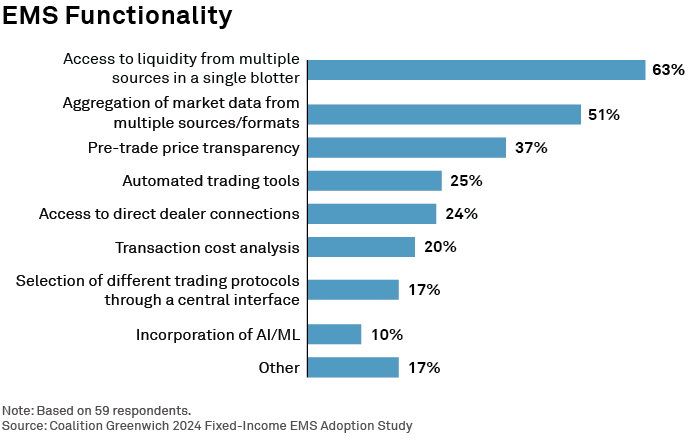

According to a recent Coalition Greenwich study of 70 buy-side professionals, access to liquidity from multiple sources on a single blotter was the top reason for EMS adoption, followed by aggregation of market data from multiple sources and pre-trade transparency.

Evolving Applications

Undoubtedly, it takes time and effort to get EMS adoption right. It took Allspring six months to see real benefits, after which, “the curve started to go vertical,” said Claeys.

For Middleton, four key benefits emerged as adoption evolved: 1) Superior trade execution in terms of increasing the opportunity for alpha, 2) More proactive decision-making in terms of the discrete liquidity opportunities, 3) Enhancing the trader’s value-add proposition in the investment process by removing manual touches, and 4) Trading protocol flexibility not only in being able to choose between, say, a request for quote or portfolio trade but also being able to choose traditional bilateral negotiation—which is “still a big part of EMS workflows,” he notes.

“Improving pre-trade price transparency and access to liquidity from a centralized location are a powerful starting point,” agreed Michael Kovach, Head of Fixed Income Sales at EMS provider FlexTrade. “But eventually, clients like to go beyond table-stakes functionality to more advanced ways of taking advantage of EMS technology, such as smart order routing and deeper utilization of market data.”

The Benefits Curve

Nevertheless, technology cost and integration complexity are deterrents, according to the Coalition Greenwich study. For traders, “the disruption to their current workflow and their role” is the biggest hurdle, added Middleton. However, buy-side firms need “to look at the direction of travel for fixed income markets in terms of scale, size of fund flows and velocity of inventory turnover,” he asserted. “Bilateral negotiation is still a big deal, but there are more efficient ways to negotiate trades than an IB chat or over the phone.”

Plus, the benefits of EMS go beyond the trading desk, according to Claeys. Running all trades through EMS can lead to straight-through processing and streamline the backend. “We're talking about a way that an EMS can cut costs for other areas of the organization.”

OMS EMS Integration Is Essential

Meanwhile, EMS providers are refining their solutions to address market challenges. As Kovach pointed out, “The need to increase intelligence around trade decisions is on the rise,” given the proliferation of ETFs and as portfolio managers move to attribute-driven strategies versus the CUSIP-selection processes. Hence, FlexTrade is building tools such as data analytics into its EMS.

“More PMs are asking for PM-specific EMS builds, while traders want an OMS view so that they can see holdings and inventory… We have the ability to expose liquidity to PMs and holdings to execution traders. Everyone in the investment process is connected—and their tech stack should reflect that,” he stated.

Deeper OMS-EMS integration is not only essential to “capture the full benefit of an EMS platform,” but it will also spur buy-side adoption, added Middleton. “I want my trading desk to have full flexibility of an order in the EMS. So, if they get an alert about a particular CUSIP they're trading, and there's a cheaper opportunity with the same risk, they should have full flexibility to substitute that out. That substitution should get reflected into the OMS and into the portfolio management tools without having to kick the order back to the OMS, potentially missing an opportunity,” he explained.

Expanding The Asset Class Pool

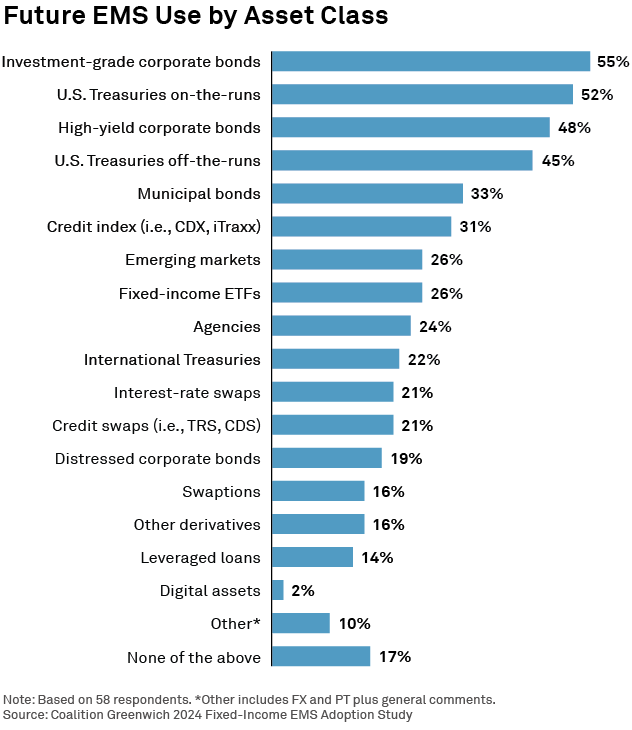

Going forward, buy-side firms expect fixed income products such as investment-grade and high-yield corporate bonds, on-and-off-the-run U.S. Treasuries and municipal bonds to be included in EMSs, according to the study.

Middleton expects growing algorithmic pricing and electronic trading in munis, and the increase in multi-asset class portfolios to fuel this. “Having the ability to trade a diverse set of asset classes within your EMS highlights the value proposition not only of the EMS, but also for trading desks to be able to bring those concepts to fruition.”

Added Claeys: “I think it's a matter of understanding the degree of difficulty of the asset class you want to bring onto an EMS and the use case at your firm.”