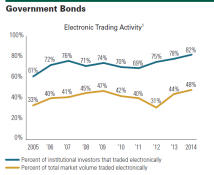

Although ideally suited to electronic trading, the U.S. Treasury market saw a significant drop in e-trading volumes following the financial crisis.

Electronic trading in government bonds now surpasses pre-crisis levels, but short-term debt has been slower to recover.

In the dealer-to-client space, competition has been fierce between the two dominant firms—Bloomberg and Tradeweb. Greenwich Associates expects dealer-to-dealer platforms to slowly enter the client execution space as well, with BrokerTec and eSpeed being the primary players in the interdealer space.

Between February and April 2014, Greenwich Associates interviewed 1,067 U.S. institutional investors active in fixed income. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.