The potential applications of blockchain-style distributed ledgers in the institutional capital markets are many and recent research by Greenwich Associates finds that risk reduction tops the list of benefits.

OTC derivatives, private stock, repo, and loan markets are asset categories likely to profit from distributed ledger technology.

While more established markets like U.S. equities could benefit from the blockchain approach as well, those financial products where automation is still limited are most likely to see quick adoption. With nearly half the firms participating in the study actively investigating blockchain and digital ledger technologies, eventual acceptance seems all but guaranteed.

Methodology

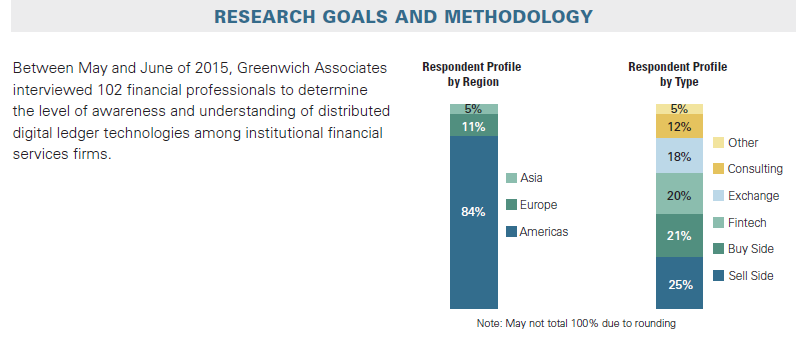

Between May and June of 2015, Greenwich Associates interviewed 102 financial professionals to determine the level of awareness and understanding of distributed digital ledger technologies among institutional financial services firms.

The data reported in this document reflect solely the views reported to Greenwich Associates by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results. Unless otherwise indicated, any opinions or market observations made are strictly our own.