The blockchain’s utility is quite straightforward—it keeps databases in sync and ensures that every transaction entered into those databases is legitimate. But taking that premise and deploying it broadly within institutional capital markets is a complex undertaking.

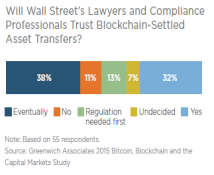

Determining whether a privatized blockchain model is viable involves complicated issues like incentivizing participants to keep the network operating, addressing real security concerns and getting the legal system, compliance professionals and regulators to accept blockchain-settled asset transfers.

Methodology

Between May and June of 2015, Greenwich Associates interviewed 102 financial professionals to determine the level of awareness and understanding of distributed digital ledger technologies among institutional financial services firms. Additional data was collected from 55 interviews in July 2015.