Pay levels in asset management in 2015 are projected to be slightly lower from last year, according to the results of the 2015 Asset Management Compensation Study by Greenwich Associates and Johnson Associates.

Such a result would represent a dramatic shift for an industry that, until recently, had experienced strong asset growth driven by both market appreciation and net inflows.

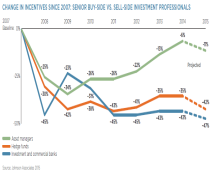

For asset managers, the uptick in market volatility will likely result in wider differentials in pay due to variation in incentive compensation pools.

Moving forward, hedge fund compensation could hold up better than pay at traditional firms, as return-hungry investors direct assets to alternative products.

MethodologyIn this report, Greenwich Associates and Johnson Associates present the key findings of their joint 2015 Asset Management Compensation Study. Results are based on data collected by Greenwich Associates through telephone and in-person interviews with more than 1,000 financial professionals in equity and fixed-income investor groups at investment management firms, mutual funds, hedge funds, banks, insurance companies, government agencies, and pensions and endowments, as well as users of foreign exchange at large corporations and financial institutions.

Armed with this self-reported data as a baseline, Johnson Associates uses proprietary information on compensation and other industry data to project compensation levels and trends for 2015. Johnson Associates actively monitors compensation trends and issues through intensive research and ongoing client assignments.

In select areas, the self-reported information from investment professionals may not necessarily align directly with overall market trends. Some of these variances can be explained by different sample sets of professionals year-over-year, or specific circumstances related to individuals (transfers, new hires, promotions, change of job, etc.).