ETFs are becoming a staple of European institutional equity portfolios. The results of the Greenwich Associates 2015 European Exchange-Traded Funds Study show that equity and fixed-income ETFs are on a solid growth trajectory in terms of both number of institutional users and overall investments. That momentum helped drive overall ETF allocations among institutional users in Europe to 9.3% of total portfolio assets in 2015, up from 7.2% in 2014.

Looking to the future, however, ETF growth in the institutional channel will be driven less by the continued advance of equity ETFs and more by the spread of the funds into new asset classes and applications.

The study results identify five emerging trends that will augment growth in equities and drive the expansion of ETFs throughout institutional investment portfolios in Europe:

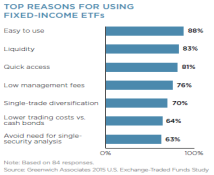

- Liquidity needs will fuel demand for ETFs in fixed income.

- ETFs are increasingly being used for core, strategic and tactical applications.

- Growing numbers of European institutions are using ETFs to replace derivatives positions.

- Innovative fund types, such as smart-beta ETFs, will provide new ways for investors to obtain exposures.

- The growing popularity of multi-asset funds is creating new demand for ETFs among the asset managers that offer these products.

These findings suggest the flexibility and adaptability that allow institutions to find new ways to apply ETFs in their portfolios will play a central role in the continued proliferation of the funds in the institutional channel.

MethodologyGreenwich Associates interviewed a total of 123 European-based institutional investors, 68 of which were exchange-traded fund users and 55 were non-users, in an effort to track usage behaviors and examine perceptions associated with exchange-traded funds. The respondent base consisted of 58 pension funds (corporate funds, public funds, and other institutional investors), 46 asset managers (firms managing assets to specific investment strategies/guidelines) and 19 insurance companies.