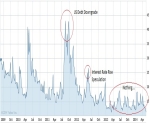

Its a little sad how excited I get about charts. Maybe its because they do such a good job telling a complex story, or maybe because looking at a chart is easier than reading - but I digress. Another great view of the fixed income world...

Its a little sad how excited I get about charts. Maybe its because they do such a good job telling a complex story, or maybe because looking at a chart is easier than reading - but I digress. Another great view of the fixed income world...

Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away. Source:...

I'm a little obsessed with volatility lately - well, the lack of it actually. The VIX has been hovering around 12 for months despite emerging markets turmoil, rigging scandals and regulatory environment that can only be described as volatile....

Liquidity in the corporate bond market is tough. We've written about it time and time again. At a high level we see two solutions. One, inject new electronic trading tools and liquidity providers into the existing corporate bond...

On Thursday May 1 the CFTC released an eagerly awaited clarifying document outlining when and how package trades would be required on SEF. Packaged transactions will be phased in by type from May 15th through November 15th, and to deal with...

Last week I did an interview with the guys at DerivAlert about where we've come and where we're going. The result was a pretty concise overview of our thoughts on SEFs, US Treasury's, corporate bonds and European regulatory reform, so we...

If you work in institutional finance you’ve heard talk of market structure. Not only are there entire conferences dedicated to the topic, but most of the participants at those conferences— banks, asset managers, researchers—send their heads of...

Capital is expensive and getting more expensive. But the problem is proving a much harder one to manage in Europe, with European banks continuing to deleverage and already complying with the principles of Basel III while US banks have their capital...

Turned out the first week of mandatory SEF trading was a Big Bang, just in the wrong direction. Reported SEF volumes for interest rate swaps fell off a cliff for the week of February 17th, cliff signdropping 64% (revised down slightly as new data...

We spoke to just under 500 portfolio managers and traders globally to see what they’re doing with and what they think about OMSs, trading-system EMSs and TCA platforms for Equities, FX and Fixed Income. This is not a space of dramatic year on year...

We are always here to help you