Crypto is playing a bigger role in the U.S. presidential election than ever before and is having an outsized influence on candidate fundraising. For instance, single-issue crypto PACs like Fairshake are supporting leaders who would enable crypto...

Crypto is playing a bigger role in the U.S. presidential election than ever before and is having an outsized influence on candidate fundraising. For instance, single-issue crypto PACs like Fairshake are supporting leaders who would enable crypto...

On February 18, 2021, the U.S. Congress held the first hearing related to the GameStop trading abnormalities. During this hearing, U.S. Representative David Scott (D-GA) raised the issue of social media’s effect on capital markets trading, calling...

Since the passage of Dodd-Frank in 2010, every time a Republican proposed a Dodd-Frank replacement in Congress, or a Republican regulator proposed a new, sensible rule, I barely paid attention. I read the headlines, would sometimes read the...

The penetration of electronic trading across the financial markets is remarkably inconsistent. While equities and foreign exchange are largely traded over platforms, the same cannot be said for much of the fixed income market. Over-the-...

I’m not a great fan of regulation for regulation’s sake. While this is too strong and cursory a judgment on what has been happening in the US and Europe for the past few years, some suggested regulatory changes make you wonder. For instance,...

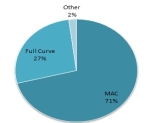

The biggest finding in our latest report (available to market structure and technology customers) on FX electronic trading was nothing. Our 1500+ interviews with global FX users showed continued growth in electronic trading (74% of users...

If you work in institutional finance you’ve heard talk of market structure. Not only are there entire conferences dedicated to the topic, but most of the participants at those conferences— banks, asset managers, researchers—send their heads of...

Its been my experience that many in the market are ignoring FX in the global derivatives reform debate, thinking of them as broadly exempt from new rules. This view is a bit of a red herring. Our latest research report digs into the regulations set...

The CFTC issued a slew of new guidance and rules last week, two of them particularly interesting and impactful. First was the rule that requires clearinghouses to have credit facilities available to back up all margin posted in US Treasuries. I (and...

Earlier this week the first two made available for trading applications were made to the CFTC starting the clock ticking for mandatory mat chartSEF trading. Those applications started a debate as to exactly how mandatory SEF trading should be phased...

We are always here to help you