According to Liquidnet CEO Seth Merrin the corporate bond market is “a disaster waiting to happen”. A disaster? Maybe. But certainly it is a market waiting for better ways to match buyers and sellers. That is exactly what Liquidnet was thinking...

According to Liquidnet CEO Seth Merrin the corporate bond market is “a disaster waiting to happen”. A disaster? Maybe. But certainly it is a market waiting for better ways to match buyers and sellers. That is exactly what Liquidnet was thinking...

Over the past decade or so, the growth of OMS and EMS platforms has paralleled the growth of electronic trading – but it would be a stretch to suggest a direct cause-and-effect relationship. These days, though, given the growing importance of...

If you work in institutional finance you’ve heard talk of market structure. Not only are there entire conferences dedicated to the topic, but most of the participants at those conferences— banks, asset managers, researchers—send their heads of...

Turned out the first week of mandatory SEF trading was a Big Bang, just in the wrong direction. Reported SEF volumes for interest rate swaps fell off a cliff for the week of February 17th, cliff signdropping 64% (revised down slightly as new data...

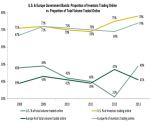

We all know that the massive reduction in dealer inventories and the cost of capital has had a huge negative impact on liquidity in the corporate bond market. While the primary market has helped soften the blow, that crutch isn’t going to be here...

Tuesday February 18th is certainly a big deal. Requiring swaps to trade on registered platforms was one of the primary tenets of derivatives reform since shortly after the Lehman big bang theory bankruptcy, and finally the day has arrived. This is...

Its true. If you step back and think about it for a minute, the work carried out over the past four years to create an electronic swaps metia-logomarket almost from scratch is pretty amazing. PR Metia just released their FinTech Insight 2014 report...

The year 2013 will likely go down as the year of mandatory clearing. Once ignored by eager financial market Greenwich Associatesprofessionals as boring back-office stuff, collateral management, credit limits and all other things clearing stood front...

Who would have guessed that Black Friday would have turned out to be a big day for SEF trading. Both Javelin and Tradeweb resubmit their MAT filings, both scaling back the number of products made available for trading. This is a big deal for a few...

Forgive me if I’m stating the obvious for some of you, but I’ve had this conversation more than once and felt some clarity was in order here. As we work through the made available to trade (MAT) process, it’s important to reemphasize what actually...

We are always here to help you