The anniversary of the Treasury "flash crash" and next week's market structure meeting at the NY Fed has brought with it a renewed focus on the functioning of the US Treasury trading. In an effort to provider further clarity into how this...

The anniversary of the Treasury "flash crash" and next week's market structure meeting at the NY Fed has brought with it a renewed focus on the functioning of the US Treasury trading. In an effort to provider further clarity into how this...

Our conversations with dealers over the past few months have left us wondering if volume weighted market share is the right metric for gauging success in fixed income dealing. In past years market share always brought with it bragging rights,...

Market structure happenings have been fast and furious since 2009, and 2014 did not disappoint. Mandatory SEF trading finally began, fixed income electronic trading continued its steady incline, the current shape of the US equity market was...

The penetration of electronic trading across the financial markets is remarkably inconsistent. While equities and foreign exchange are largely traded over platforms, the same cannot be said for much of the fixed income market. Over-the-...

Market structure changes in the bond market appear to be happening organically. Shocking I know. Rewind back seven years to 2007. Market structure research was primarily focused on technology innovation, evolving business models and a...

According to Liquidnet CEO Seth Merrin the corporate bond market is “a disaster waiting to happen”. A disaster? Maybe. But certainly it is a market waiting for better ways to match buyers and sellers. That is exactly what Liquidnet was thinking...

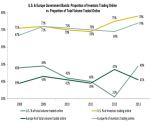

Those of us tracking the broader fixed income market have become quite familiar with the chart showing dealer inventories of corporate bonds falling through the floor, but this chart of bank US Treasury holdings totally blew me away. Source:...

Liquidity in the corporate bond market is tough. We've written about it time and time again. At a high level we see two solutions. One, inject new electronic trading tools and liquidity providers into the existing corporate bond...

Turned out the first week of mandatory SEF trading was a Big Bang, just in the wrong direction. Reported SEF volumes for interest rate swaps fell off a cliff for the week of February 17th, cliff signdropping 64% (revised down slightly as new data...

We all know that the massive reduction in dealer inventories and the cost of capital has had a huge negative impact on liquidity in the corporate bond market. While the primary market has helped soften the blow, that crutch isn’t going to be here...

We are always here to help you