Crypto is playing a bigger role in the U.S. presidential election than ever before and is having an outsized influence on candidate fundraising.

For instance, single-issue crypto PACs like Fairshake are supporting leaders who would enable crypto and blockchain technology, with Fairshake alone having raised over $200 million as of September month-end.

Also, Howard Lutnick, CEO of Cantor Fitzgerald and well-known Bitcoin supporter, has assumed a leading profile with the Trump campaign and been named as the co-chair of the Trump transition team.

There has also been policy engagement by the Harris campaign, with crypto becoming somewhat more of a bipartisan topic—especially now that there are donations to be raised and policies to be shaped. The influence of the people and cash coming out of Silicon Valley broadly and crypto more specifically can’t be ignored.

What’s at Stake in Market Structure

From a market structure perspective, much hangs in the balance around this election. It’s not only the potential regulatory environment but also the legislative agenda—particularly as the Chevron deference standard was weakened in the courts, making Congressional action more necessary.

Whereas in the past, courts could defer to the views of regulators on matters they have previously examined, the 2024 ruling states this is no longer the case, thus removing some powers from those regulators. For instance, the decision could impact the SEC’s regulatory and enforcement agendas by providing a new path to challenge the SEC’s authority in digital assets (and other areas where the agenda was more ambitious), including SAB 121.

For crypto, the SEC is the clear “elephant in the room” on the regulatory front, with enforcement actions driving the U.S.’s crypto agenda over the past several years. Chairman Gensler’s current appointment goes through 2026, but a Trump presidency would likely mean a new Chairman. The SEC staggers the appointment of its five commissioners, however, so the election will not change the composition of the SEC overnight.

It is often said that personnel is policy, but personnel at the SEC and other agencies like the CFTC will need Senate confirmation. Therefore, the complexion of the U.S. Senate is also impactful for who ends up staffing the agencies and regulating crypto.

The biggest items being watched by the industry are the following:

- Market structure, and the definitions and roles of custodians of digital assets, exchanges and brokers in the U.S. ecosystem

- Stablecoins, where there is a desire and agenda to legislate

- Tokenization, where the real-world assets are being tokenized under different jurisdictions but where the U.S. has lagged international markets, including for regulated securities

More than a Change in Tone in Washington, DC?

Market structure for digital assets could shift considerably post-election. An optimistic scenario for digital asset enthusiasts would go beyond simply the friendly tone of the campaign to actual presidential transition teams staffed by crypto-friendly people, proposed lists of new heads of agencies who are crypto-friendly, and Congressional staffers exploring new policies and proposing new legislation that provides greater clarity.

In a way, the regulatory environment has become more hospitable to crypto even before the election. For instance, BNY Mellon recently received word from the Office of the Chief Accountant of the SEC that it can offer custody for asset managers issuing crypto ETPs on a case-by-case basis.

Further shifts in SAB 121, always controversial as it requires banks to put any crypto holdings on their balance sheet and disclose related risks, could come as early as January, with the departure of a president inclined to use veto powers, offering further clarity on the role of custodians for digital assets and how they might offer services while still protecting customer assets. A shift would likely lead to major custodial banks, like BNY Mellon, State Street and Northern Trust, and even other investment banks, moving deeper into the digital asset sector.

Custody matters—a lot. This is for both technical reasons due to the unique nature of crypto assets as well as supporting institutional adoption. We see institutional-grade infrastructure, including well-regulated custody, as critical to the development of the ecosystem. Moreover, the industry also needs institutional-grade data, analytics and tools to support front-office professionals (PMs, analysts and traders) in their never-ending request for higher returns and alpha in digital assets.

These and other shifts have the potential to unleash a flurry of changes that will make it easier for institutions to invest in and trade spot crypto and move beyond some of the more basic investment products, ETFs/ETPs and exchange-traded futures (like futures on CME or CBOE) and potentially become more like global FX trading in the U.S.—similar to what is happening in places like Singapore, Hong Kong, the Middle East, and Switzerland.

Stablecoins Hang in the Balance

Moreover, the role of cash and cash-like instruments on public blockchains or distributed ledgers hangs in the balance as well, since Washington has been inclined to legislate on this topic, and other markets have adopted their own forms of regulation (e.g., MiCA in Europe). The U.S. dollar, and what amounts to tokenized dollars on public blockchains, is an economic, monetary policy and national security topic involving many agencies and government departments, including the U.S. Treasury and Federal Reserve.

How the U.S. Senate determines the ultimately bipartisan legislation on this topic will be clearly influenced by this election with eight or so competitive Senate races. Shifts in either direction could influence the role of stablecoins in the U.S. and whether the U.S. leads or if tokenized dollars are traded mostly outside U.S. borders.

The Tokenization Journey

Tokenization clarity is also on the industry’s post-election wish list. In the coming months, we expect continued progress on the range of assets being tokenized via blockchain technology, but so far, progress has been mostly outside the U.S. The focus thus far has been on tokenizing money market funds, bonds, private funds, venture capital, and non-U.S. FX. But with new sandboxes and DLT pilots in places like the U.K. and Singapore, this will enable firms to experiment.

Regulation of these assets is a clear driver of growth. MiCA in Europe is providing a path for financial instruments in Europe to see greater use of blockchain technology. We expect momentum to pick up after the U.S. election and into 2025, moving beyond pilots to actual production in a variety of use cases and supported by better trading and distribution, opening up the investor and product universe further. Digital bonds in places as far apart as Lugano, Switzerland and Quincy, MA are signs of more to come.

Tokenization and Collateral Management

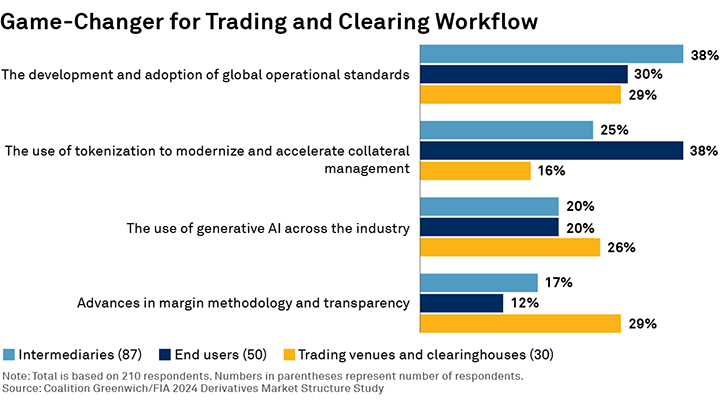

One specific area where we expect tokenization to keep up its rapid rise is in collateral. According to Coalition Greenwich research, 25% of intermediaries and 38% of end users believe that the use of tokenization has the potential to modernize and accelerate collateral management, upgrading trading and clearing workflows.1 These are areas in need of major upgrades. We believe that with advancements in tokenization, the tracking and movement of collateral can bring greater efficiency to markets.

Looking Ahead

Ultimately, the industry wants greater clarity and direction to see that time, energy and resources are not better spent elsewhere. Disagreements between the political parties, the regulatory agencies and between both have slowed down relative progress in the U.S. Knowing the rules of the road, even if they are burdensome, will allow many to define the path forward. We recognize that what candidates say on the campaign trail and what they do once they are in office don’t always align. But current rhetoric suggests that elections matter and have real consequences.

David Easthope is the author of this publication.

1Based on interviews conducted between November and December 2023 with 210 derivatives market participants and experts sourced from the Coalition Greenwich network and the FIA community, including asset managers, hedge funds, clearing firms, brokers, swap dealers, and others.