Bank relationship rationalization and the easing of crisis-era concerns about counterparty risk in the U.S. associated with key bank relationships could be setting the stage for increased...

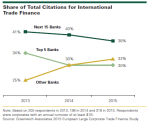

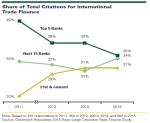

Large European companies are lowering costs and simplifying operations by consolidating trade finance for transactions in their home region into the hands of large banks like BNP Paribas, Deutsche...

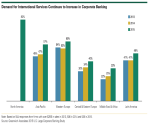

The market’s biggest banks are expanding their trade financing and servicing footprints as large U.S. companies seek support for their expanding international businesses.

Bank of America...

U.K. pension funds continue to search for answers to their ongoing underfunding problem, and asset management firms are stepping up to help.

The 2015 Greenwich Leaders in U.K. Institutional...

2015 Greenwich Leaders: Emerging Market Equities

Equity brokers in the emerging markets are rewarded for consistency.

Institutional investors like to trade with firms that remain...

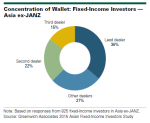

Trading volumes among fixed-income investors declined 9% from 2014 to 2015 for credit bonds, while trading for rates was roughly flat.

The drop-off in Asian fixed-income trading volume is the...

2015 Greenwich Share and Quality Leaders: European Equities

The competitive landscape of the European brokerage market has been in flux since the onset of the global financial crisis, driven by...

Falling pricing of trade finance is putting pressure on global banks, who have traditionally been the main providers to large Asian companies and MNC subsidiaries in Asia.

The evolving market...

There is only one story in Canadian fixed income this year, and that story is BMO Capital Markets.

On the strength of strong gains in estimated market share, BMO Capital Markets has closed...

Europe’s biggest allocations to equities, and those exposures—along with investments in other risk assets—are poised to grow further as institutions continue to adapt to...