The electronic trading revolution hit the foreign-exchange market years ago, but the macroeconomic and regulatory-driven events of the past few years are spurring a new wave of change.

Investors...

For asset managers selling their products on intermediary platforms, the landscape is changing quickly.

Platform gatekeepers around the world are adopting more institutional—and more demanding—...

Heightened regulatory pressures coupled with years of perennially low interest rates continue to stress banks’ trading businesses.

In response to the deteriorating economics of the rates business...

Unlike buy-side firms’ order management systems (OMSs) which had been long-term tenants on their desktops, execution management systems (or EMSs) were transients, with institutional traders commonly...

New

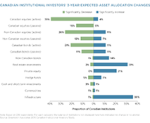

More than one-third of the Canadian public and corporate pension plan sponsors participating in the Greenwich Associates 2015 Canadian Institutional Investors Study name liability management as one...

New

Although wealth management represents a key growth driver for commercial banks, most banks are falling short of their potential when it comes to winning clients and growing assets.

Improving that...

New

Companies today have access to a broad array of tools for measuring and improving customer loyalty. In fact, picking from among the many proprietary customer experience management (CEM) approaches...

New

As customers change the way they interact with their financial institutions, many financial institutions have not yet changed the way they interact with customers to measure customer loyalty.

The...

New

Greenwich Associates provides a detailed roadmap, the CEM Maturity Path, of a customer experience management development process identified through its work helping banks design and implement CEM...

New

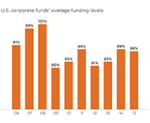

The results of Greenwich Associates 2015 U.S. Institutional Investors Study show that despite 3% growth in portfolio assets, funding levels for U.S. pension funds were flat from 2014–2015 at well...

New