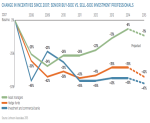

Pay levels in asset management in 2015 are projected to be slightly lower from last year, according to the results of the 2015 Asset Management Compensation Study by Greenwich Associates and Johnson...

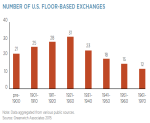

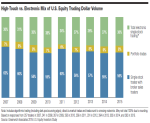

To better understand the shifting dynamics between the U.S. equities markets and technology, Greenwich Associates together with Sungard presents a comprehensive timeline of the episodes which have...

Recognizing that traditional client segmentation models lack the precision needed for efficient resource allocation, Greenwich Associates has created the Greenwich Institutional Investor Segments....

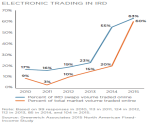

The business of interest-rate swaps trading is rapidly moving to electronic platforms. Sixty percent of notional client swap trading volume in the U.S. this year is being executed electronically - up...

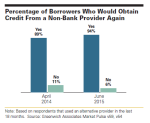

A quarter of U.S. small businesses and mid-sized companies are obtaining credit from non-bank providers, and nearly all have found the experience so positive that they would borrow from a non-bank...

The U.S. Treasury “flash crash” on October 15, 2014 acted as a catalyst for market structure change.

A market-wide feeling of content with existing relationships, protocols and...

The role of the FX salesperson is not what it used to be. Electronic trading continues to grow, while regulatory scrutiny limits what salespeople can and will tell their clients. The combination...

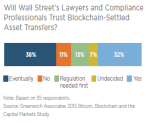

The blockchain’s utility is quite straightforward—it keeps databases in sync and ensures that every transaction entered into those databases is legitimate. But taking that premise and...

For institutional traders, the original “set and forget” approach to e-trading has been supplanted by a purposeful, spasmodic style where orders are released for a few minutes and then...

Recent research by Greenwich Associates found that regulatory mandates and shrinking margins led capital markets businesses to sink an average of $13.7 million into managing reference data last year...