Credit markets are in a period of transformation, with inflation at a multi-decade high, interest rates rising and the post-pandemic economy still an unknown. Portfolio managers have been...

This report lists the 2022 Greenwich Excellence and Quality Leaders in Global Foreign Exchange.

More than a quarter of U.S. small and mid-sized businesses say they are likely to choose a bank that demonstrates a commitment to ESG the next time they add or switch providers. That’s good news for...

Industry-wide revenue pools increased 6% year over year in fiscal year 2021, albeit via different leading and lagging business lines from the year before.

Growth in equity capital markets (ECM)...

The bond market is anything but dull these days. Average daily volume in the U.S. Treasury market was up 22% from the same month last year, with over $700 billion trading daily. Volatility also...

Corporate bond trading in the U.S. held up well in March despite the market carnage in equities and Treasuries. Volumes were only 3% above the same month last year, and only slightly lower than the...

Overall business outlook for large corporates in Asia has turned positive but risks remain as outlook continues to be uneven across markets. Digitization has come out as the key theme for businesses...

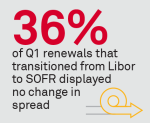

As Q2 2022 begins, most banks have moved away from originating new Libor-based loans.

Data observations from Greenwich Commercial Loan Analytics (CLA) clients show that:

SOFR and BSBY base...

The average buy-side trading desk budget is just over $2 million annually, inclusive of both technology and compensation, with roughly one-third allocated to technology spending. In aggregate,...

The following tables present the 2021 Greenwich Quality Leaders in Japan Fixed Income for yen and non-yen products.

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation