U.K. pension funds continue to search for answers to their ongoing underfunding problem, and asset management firms are stepping up to help.

The 2015 Greenwich Leaders in U.K. Institutional...

The role of the FX salesperson is not what it used to be. Electronic trading continues to grow, while regulatory scrutiny limits what salespeople can and will tell their clients. The combination...

This report provides detailed information from U.S.-based investors investing in Convertibles, including helpful benchmark data such as:

Long market value

Trading volume

Leverage ratio...

2015 Greenwich Leaders: Emerging Market Equities

Equity brokers in the emerging markets are rewarded for consistency.

Institutional investors like to trade with firms that remain...

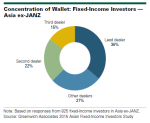

Trading volumes among fixed-income investors declined 9% from 2014 to 2015 for credit bonds, while trading for rates was roughly flat.

The drop-off in Asian fixed-income trading volume is the...

2015 Greenwich Share and Quality Leaders: European Equities

The competitive landscape of the European brokerage market has been in flux since the onset of the global financial crisis, driven by...

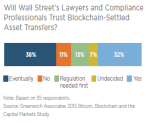

The blockchain’s utility is quite straightforward—it keeps databases in sync and ensures that every transaction entered into those databases is legitimate. But taking that premise and...

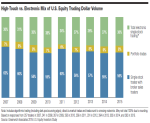

For institutional traders, the original “set and forget” approach to e-trading has been supplanted by a purposeful, spasmodic style where orders are released for a few minutes and then...

This report provides detailed information from North America-based investors investing in equity derivatives, including helpful benchmark data such as:

Product usage

Important selection...

This report provides detailed information from European-based investors investing in Convertibles, including helpful benchmark data such as:

● Long market value

● Trading volume

● Leverage...

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation