In our role as market analysts, we are lucky enough to attend some of the most interesting industry events in capital markets and FinTech. In that vein, Symphony asked us if we could attend their Innovate conference in New York this past fall and...

In our role as market analysts, we are lucky enough to attend some of the most interesting industry events in capital markets and FinTech. In that vein, Symphony asked us if we could attend their Innovate conference in New York this past fall and...

Even though the market adjusted for the SEC’s Tick Size Pilot, there would still be considerable technological work for firms to be able to properly incorporate Nasdaq’s proposed tick size regime.

The fragmentation of the FX market structure is legendary, so consolidation within it is always of interest.

Over the years trading desks at the largest banks and broker-dealers profited not just from executing client trades, but because they had the pulse of...

Call them what you will – non-bank liquidity providers, principal trading firms, high frequency traders, electronic market makers – but this not-so-new-anymore breed of market participants is increasingly important to market liquidity,...

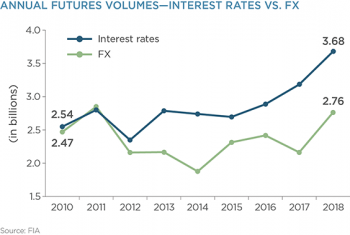

Given recent changes, FX futures and similar instruments have the potential to grow fast enough that FX may eventuially follow int he footsteps of U.S. Treasuries...

With Bitcoin topping $11,000 this weekend for the first time since March 2018, the crypto winter is definitely over. The same cannot be said for enterprise blockchain initiatives.

The RFQ market for U.S. Treasuries, pioneered by Tradeweb in 1999, helped traders of the time make the leap onto the screen by making their current workflow more efficient while still knowing their clients. RFQ trading has evolved to allow further...

Following recommendations from the SEC's Fixed Income Market Structure Committee (FIMSAC), FINRA is proposing a pilot program to test the impact of changing the reporting requirements for large corporate bond trade.

On any given day in the U.S. corporate bond market, roughly 70% of the trades executed are for 100 bonds or fewer (equivalent to $100,000 or less). Greenwich Associates data shows that the vast majority of these trades—over 90%—are now done on...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder