In a market with rising volumes and volatility, yet continuing commission compression and challenging regulatory scrutiny over every aspect of the trade life cycle, more and more firms have begun...

In 1Q22 Coalition Index Investment Banking revenues were down by (11)% on a YoY basis.

IBD: Significant decline in IBD was mainly driven by ECM and DCM fully offsetting the growth in M&A (...

Corporate bond new issuance is trending downward, following an absolutely blockbuster year in 2021 and a stronger than anticipated Q1 2022. While this expected lull in the action isn’t good news...

Municipal bond prices have been on a roller coaster over the past two years along with the rest of the U.S. bond market.

Credit markets have come under immense pressure in 2022. A litany of market frictions this year have created new trials and tribulations for corporate bond traders while exacerbating some...

More than half a trillion dollars of green bonds were issued in 2021, the highest level since the market was defined. This category encompasses both bonds that include incentives based on issuer...

Securities services firms occupy a vital role in the smooth functioning of the capital markets industry. Mutual funds, ETFs and others rely on these providers to ensure that the operational...

Credit markets are in a period of transformation, with inflation at a multi-decade high, interest rates rising and the post-pandemic economy still an unknown. Portfolio managers have been...

Industry-wide revenue pools increased 6% year over year in fiscal year 2021, albeit via different leading and lagging business lines from the year before.

Growth in equity capital markets (ECM)...

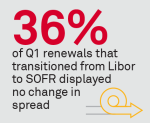

As Q2 2022 begins, most banks have moved away from originating new Libor-based loans.

Data observations from Greenwich Commercial Loan Analytics (CLA) clients show that:

SOFR and BSBY base...