Companies around the world are in the process of introducing environmental, social and governance (ESG) and sustainability goals into corporate finance and treasury functions. As they do,...

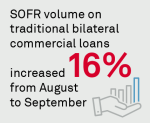

Data observations from Greenwich Commercial Loan Analytics (CLA) clients show that:

More than half of CLA clients originated a SOFR or BSBY loan in September

Libor-based transactions still...

While retail investors have taken to do-it-yourself tools in unprecedented numbers over the past two years, their use of financial advisors remains strong. Markets have generally gone up since...

As cryptocurrency moves from a largely retail product at the edges of the market place to a product that engages a broad set of institutional investors across the financial markets, impediments...

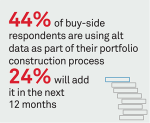

Alternative data or “alt data” are new, unique data sources that can add valuable explanatory power to both quantitative and fundamental investment models. Originally, alt data for investment and...

Asset managers are working to create “client-centric” business models that allow them to deliver superior service to all clients and to partner with their best clients as strategic advisors. This...

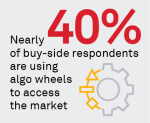

Driven by COVID-19 lockdowns, retail enthusiasm, meme stock adventures, and more, the markets had an amazing year into the first quarter of 2021. The spending trends reflect that trading boom,...

The global financial crisis of 2008 drove a massive reexamination of how the market and its participants operate. The more recent focus on environmental, social and governance (ESG) metrics by...

Regionally, APAC and Americas were affected the most by the lower interest rate environment, partially offset by higher fees. EMEA, on the other hand, outperformed led by better performances in the...

The Coalition Index for U.S. Commercial Banking – 1H21, covers these critical performance metrics, including comparisons for pool concentrations, revenues across products, and aggregate deposits and...