U.S. option market volumes caught fire in 2021. Records were made, broken and then almost immediately broken again. The top six volume months in the history of the Options Clearing Corporation (...

Digital asset market structure to date has been built primarily with retail, high-net-worth, venture capital, family office, and crypto-native investors in mind, as they have been the most ready...

While businesses tried to get back to business in 2021, the year was far from normal. In fact, it seems unlikely that normal will ever be uttered again about global markets. But maybe that’s a...

FICC: FICC revenues declined by (16)% YoY due to lower volumes across products as spreads tightened and volatility remained muted. Decline in FICC revenues was mainly driven by Macro products in both...

Holistic surveillance practices have evolved significantly in recent years, and never more so than during the industry’s historic transition to remote working environments in 2020. Effective...

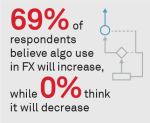

The use of algorithms in foreign exchange (FX) execution remains less prevalent than in equities. Market practices change over time, of course, and disruptions such as the pandemic then...

In its early days, alt data for investment and trading decisions was procured separately from traditional market data. Today, traditional financial information vendors and aggregators have...

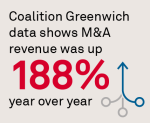

A lot has happened since the beginning of 2020, including the growth of electronic trading in nearly every major asset class around the world. Coalition Greenwich interviews roughly 4,000...

Stablecoins are digital tokens pegged to major currencies or commodities and are often backed by transparent reserves, though not all follow this logic. Major stablecoins today include USDC, Dai...

While a lot can happen in the last few months of 2021, especially with a Fed taper looming and equity markets starting to wobble slightly, Coalition Greenwich expects corporate and investment...