The personal loan market proved remarkably resilient over the past year, despite early concerns that the COVID-19 crisis would create a spike in defaults. Government intervention and the...

In the fall of 2020, the SEC proposed new rules to enhance oversight of electronic execution venues trading U.S. Treasuries and U.S. agency securities. While the “flash rally” of 2014 drove the...

Client segmentation is a fundamental tool to improve profitability in most industries, yet it remains woefully underutilized by asset managers. Why is this the case, and what can managers do to...

When the magnitude of global events and a sudden shift to home working environments unfolded in early 2020, financial firms found their compliance systems and practices under a spotlight. With...

A pandemic. A historic market rout. A historic market rally. An election. Outsourced trading. One of these things does not belong. Or does it?

When we look back at 2020 and into 2021, the...

2020 was not a year of massive change for equities TCA, but rather a steady continuation of the adoption of TCA techniques, tools and analytics.

With the continued rise of analytics and...

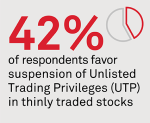

No one will ever claim that 2020 was a dull year. The world reacted to the start of a global pandemic, the United States had its most contentious presidential election in modern history, and the...

While 2020 is (thankfully) over, it is most certainly not forgotten. Without a doubt, 2020 brought with it the biggest set of market structure related events since the global credit crisis of...

During the onset of the COVID-19 pandemic, between late February and early April 2020, the U.S. capital markets experienced unprecedented volumes and volatility, with various records being broken...

The shareholder litigation landscape is rapidly changing across the globe. The U.S. remains the most active region, with over 400 federal class action lawsuits filed in 2019. Over $3.2 billion in...